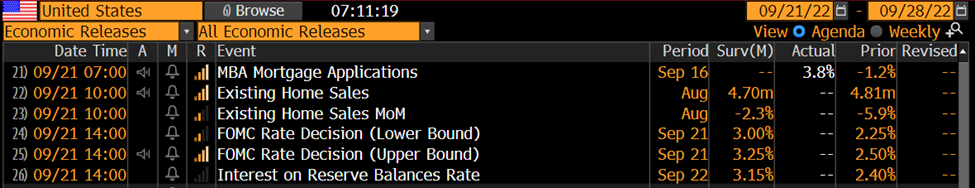

The markets are attempting to get out of their rut after an ugly day yesterday and ahead of the Feds decision at 2pm. DOW FUT +0.4%, S&P +0.38%, NAS +0.18%, Gold +0.73%, Oil +2.44% after Putin’s speech and the US 10yr is taking a break down 4bps @3.53%. Asian markets all closed in the red and Euro markets are in the green with Uniper down ~30% after government take over. It’s Fed day! Some more data out this morning, mortgage apps rise for the first time in six weeks despite much higher rates.

Markets closed down about 1% yesterday but off their lows. It was a battle between ugly and worse most of the day. The US 10yr closing above 3.5% and the 2yr closing shy of 4%. More stocks hit 20d and 52wk lows and the percentage of stock that are above their 50dma sits are 22%, the lowest level since mid-July. Adv/Dec was a bit ugly a -7 to 1 but the put/call data continues to be low. The market internals are weak and, in a downtrend, while heading into a huge day. While we may see a rally today, we continue to look at the bigger picture and continue to believe that the market will keep moving lower. We need to see more support from within before we switch our thinking.

The Feds decision today will certainly give investors some excitement. Sweden’s Riksbank increased rates by an unexpected 100bps yesterday, it is very unlikely that Powell will follow on this path, but anything is possible. A 75bps hike is priced in and it may trigger some buying as investors see the “high” hikes behind us as a buying opportunity. It is still our view that the Fed moving from 75bps to 50bps is not a pivot, but the market often rallies on this type of commentary. Powell has made it very clear that he will crush inflation at all costs, I don’t think we will see a dovish pivot for Powell today, likely his look at the data and make decision as we go.

Market News: Putin announced more troops will be mobilized and sent to Ukraine and vowed to use all mean necessary to defend Russia. HE pledged to annex the territories that are occupied by Russa and called these moves “urgent, necessary steps to defend the sovereignty, security and territorial integrity of Russia”. Putin is taking this war personally and stated that they are fighting the entirety of NATO and the US. This war is anywhere from over. Crude, gold and the USD jumped on the speech. An oil refinery in Ohio shut down after a fire. The German government has taken a 99% stake in Uniper, nationalizing the countries largest gas importer. This may turn out to be a problem because this move will give the German government ownership of assets within Russia. We will see how Putin takes this. Thousands of UK bus drivers are planning a strike over pay. The UK announced a 40B pound bailout to help companies with the energy bills. Ford got slammed yesterday after announcing warning of $1B in inflation costs. Spotify is adding an audiobook service. Peloton is selling a 3k rowing machine. AMZN’s purchase of Roomba is under FTC investigation. Hurricane Tracker: A public health emergency was called for Puerto Rico while Fiona strengthens over Turks and Caicos. There is a tropical storm, Gaston, in the middle of the Atlantic. Two low off disturbances in the eastern pacific, two low and one high odd disturbances in central Atlantic.