Another disappointing day yesterday for investors as the early morning gains couldn’t hold. Today futures have again given up the early gains. DOW FUT down 0.04%, S&P down 0.06%, NAS down 0.06%, Gold down 0.02%, oil down 0.22% @$86.67, and the US 10yr is down1bps @3.326%. Asian markets were mostly lower after China’s trade data missed expectations. European markets are in the red as recession fears grow and new data showed that energy will soon cost 20% of income in parts of Europe. Canada is set to announce their rate hike later this afternoon. In the US we saw a decline in mortgage applications again, trade balance out at 8:30, the Fed Beige Book is out at 2pm. We will hear from Fed’s Barkin, Mester, Brainard & Barr later today.

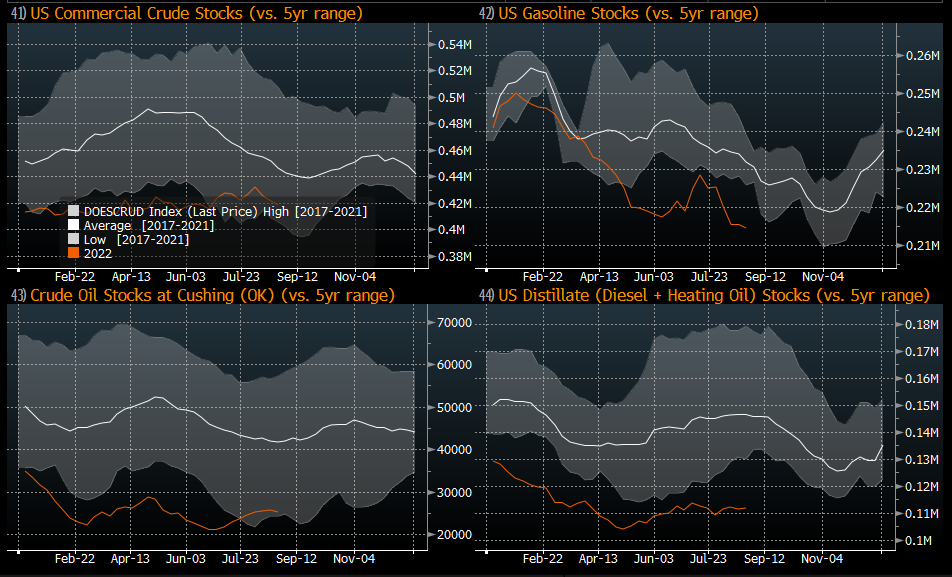

Yesterday’s gains were short lived but the market was able to close above support and trend line. Today will be important to see if it holds this level. The internals have remained poor but nothing too elevated with adv/decline -2 to 1 and new highs/lows -13 to 1. Oil prices have pulled back significantly from their highs, but inventories remain near or below 5-year ranges. The US SPR is stilling at a level that has not been seen since 1985. Putin said that they will not export oil if there is a cap on Russian oil prices. OPEC has cut production (slightly) and many members are still unable to produce at their quotas. The US recently send bombers over Iran in a show of power while the Iran negotiations are “still underway”. It seems like they are dead in the water. With little support coming from the US E&Ps the writing is on the wall that the world is not anywhere near getting out of this energy crisis.

Market News: Labor Day weekend air traffic surpassed pre-covid levels. Elizabeth Holmes is hoping for a new trial. Apple is set to release its iPhone 14 today along with other products. The US and China are seeing one of the first space conflicts, as both countries are hoping to land in the same place on the Moon. Putin went and watched the China & Russian troops train together and was pleased with how China has had a balanced approach with the Ukraine conflict. Blackout hit 75k in Cali as rolling blackouts are imminent. Dozens of companies such as DE, WMT, NSRGY LOW, and more issued a huge amount of debt ahead of the CPI print and fed meeting in a few weeks. Are they preparing for higher rates for longer? Google CEO hinted at potential cuts coming. Hurricane tracker: The hurricane off Baja, Kay, is expected to make landfall by Thursday, the hurricane off the Bahamas (Earl) is set to generate swell around Bermuda but not too much more, the hurricane headed for Europe (Danielle) is set to be around Portugal by Monday and there is now one storm with a 60% chance of becoming a tropical storm in the middle of the Atlantic.

WHC TOP 5: CEG, EXTR, CROX, PCTY, and TTD