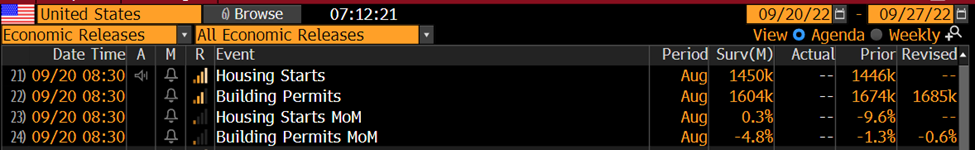

The green day yesterday was an pleasant change to last weeks bloodbath but it seems like it was short lived. DOW FUT -0.33%, S&P -0.45%, NAS -0.57%, Gold -0.06%, Oil +0.16%, and the US 10yr +6bps @3.549%. Asian markets closed in the green and European markets are in the red. German PPI came in this morning at horrific levels. YoY came in at 45.8% vs 36.8% expected and 37% last month. MoM came in at 7.9% vs 2.4% expected and 5.3% last month. The main drivers were electricity and gas prices. With prices increasing at this rate, Germany will be crippled. The energy crisis is anything but over. Governments are trying to do anything to sold the crisis, in an absolute joke of a suggestion, the Swiss Environmental Minster suggested that people should shower together to save energy. In Japan, CPI came in hotter than expected and the highest core inflation increases the fasted in 8 years. A further point that higher prices will be here for longer. In the US we have some housing data out, likely to disappoint after the low homebuilder sentiment that came out yesterday. All are waiting for Powell tomorrow.

The market turn yesterday was a happy sight but little internal breadth does not change the bigger picture. Adv/Dec 2 to 1 was nothing to write home about, and we only saw a minor improvement with stocks above their 50dma. While we saw fewer stocks hit 20wk lows in the SPX, on the NYSE new 52wk lows dominated new highs, 15 to 1. The Fed will almost certainly rise rates 75bps tomorrow, which is mostly priced in at this time. The key will be the commentary he makes after this. The market could rally on hopes that this is that last 75bps hike or crash is Powell sticks to the narrative that inflation where it is, is much too high. The 10yr and 2yr are absolutely ripping, we think that this is worth watching and is more indicative of what is to come rather than any economist expectations. Heading into a major event like this while the market is in a vulnerable position is a recipe for disaster. Stay on the sidelines.

The Aramco CEO said that the global energy crisis shows how misunderstood the environment and new investment are “too little too late” in the near term. Gazprom is going to be shutting down a pipeline into China for maintenance on Thursday, this will be a good test to see how smooth this goes for Russia’s new ally China vs Germany. Reports indicate that the majority of Hungarian gas stations will go dry next week. At the same time, the EU is threatening to freeze 7.5B euros that are meant to be sent to Hungary after concerns that the PM is too friendly with Putin. Is the EU starting to crumble? Amazon is suspending construction of new warehouses in Spain in a response to lower consumption. China has had the first case of Monkeypox, will the lockdown the country for this too? The SPAC darling, Chamath Palihapitiya, has closed down 2 of his blank check companies after failing to find companies to take public. Porsche opened the books for requests for share sales and filled the $9.4B offering within hours of opening. I guess not all IPOs are dead, the stock is likely to start trading on the 29th and the expected market cap will be 75B euro. US Harvest data was weak and food supply remains tight. Ag experts are warning that drought in the US and in South America are going to keep supplies short until we see multiple good harvest seasons. The COO of Beyond Meat was arrest for third degree assault after he bit off part of someone nose after a college football game, I guess he was tired of eating plant based meat. Ukraine continues to fight Russia in an attempt to reclaim land. Occupied Kherson will hold a vote whether to join Russia. Massive earthquakes rattled Mexico and a tsunami warning was issued. Hurricane Tracker: Fiona hammed Puerto Rico after the county got 30 inches of rain. Fiona is heading towards Turks and Caicos. There is a 80% chance a storm turns into a tropical storm in the middle of the Atlantic. Madeline, the tropical storm off Baja, is still expected to head out to sea.