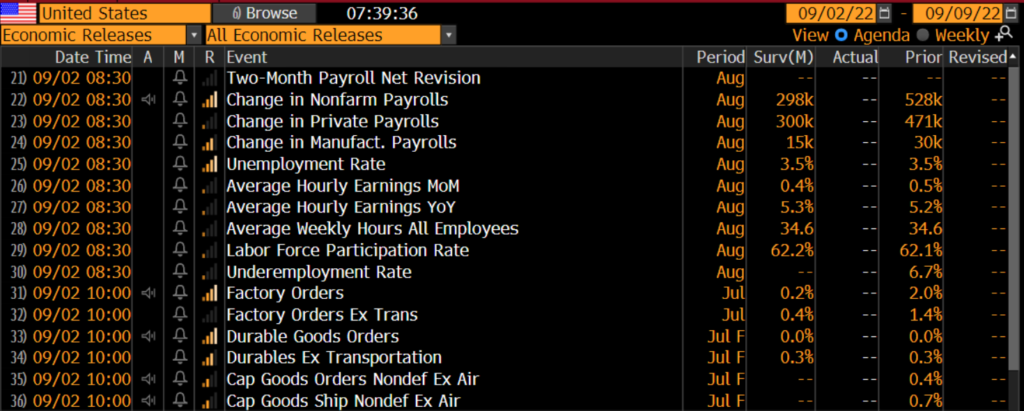

Its Friday on Labor Day Weekend, and jobs day! Futures are mixed this morning. DOW FUT up 0.01.%, S&P up 0.02%, NAS down 0.1%, Gold is up 0.43%, Oil is attempting to have a positive day up 1.72% but sill below $90 and the US 10yr is down less than 1bps @3.26%. Asian Markets were mostly lower and European Markets are all firmly in the green. Jobs number are out this morning and anything that looks ok will send markets into a dive. Based on weekly data, it seems like the jobs numbers will be solid sending markets lower.

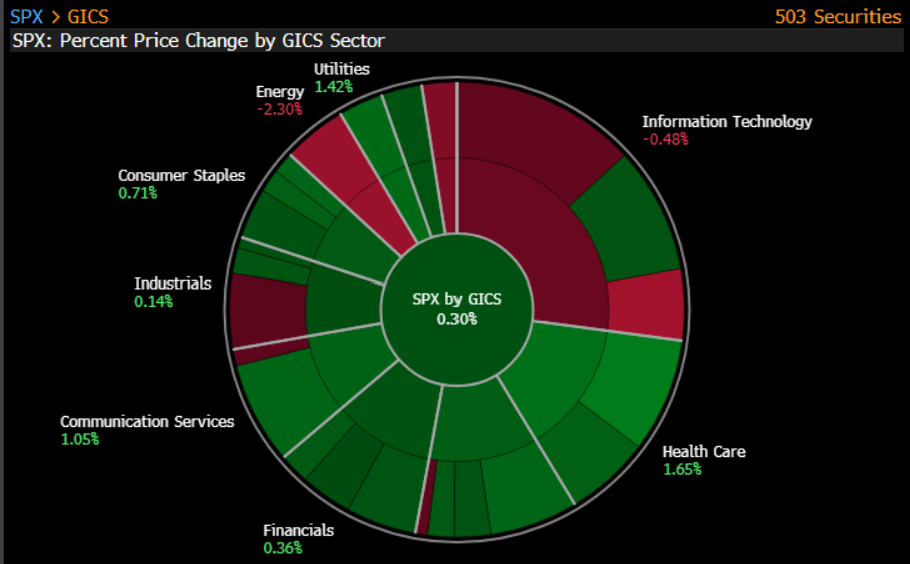

Yesterday was pretty mellow with the DOW and SPX reversing out of the red and closed higher. This move came at the end of the day suggesting that buyers wanted to get in before this jobs report at 8:30. Its possible that some people have a better idea of what the print will be and they positioned themselves to benefit from this. However, the internals don’t suggest that the market will be heading higher anytime soon. All major averages closed below their 50dma. The SPX bounced off of support at 3900, but the percentage of stocks above their 50dma is below 50%, the ADV/DEC was -2 to 1 yesterday and on the NYSE new H/L was -11 to 1. All poor internals. Of course, a horrible jobs number out today could change the course but we see the market heading lower.

Market News: Boris Johnson is calling for nuclear power in the UK where a recent report showed that it may soon be cheaper to fill you car with gas than charge up a EV. Reports are coming through that the housing crisis in China is worst than people realized. One of the grain ships leaving Ukraine ran aground in Istanbul. Brazil reported higher than expected trade surplus. Russia is apparently running out of soldiers and is now turning to prisoners, what could go wrong. Poland is asking for $1.3T from Germany for WWII reparations. LULU popped after a great quarter and higher guidance. SBUX announced a new CEO. Hurricane Watcher: WE GOT ONE! Danielle, is expected to turn into a hurricane later today and is heading east from the middle Atlantic. There are two other storms that are not as matured but we are watching. There is a typhoon that is heading towards Southern China and is expected to cross major shipping channels.

WHC TOP 5: CEG, EXTR, CROX, PCTY, TTD. TOP MACRO: Energy