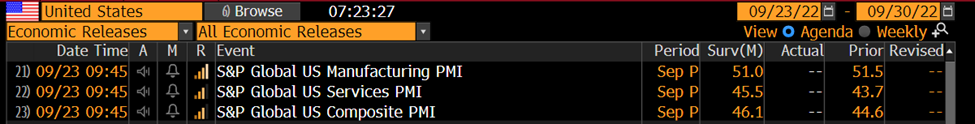

Another day of selling but at least its Friday! DOW FUT -1.14%, S&P -1.25%, NAS -1.31%, Gold -1.56%, Oil -3.5%, the US 10yr +4bps @3.75%, the 2yr briefly reach 4.26% but is currently @4.2%. Asian markets finished in the red and Singapore’s inflation of 7.5% YoY hit levels last seen in 2008. European markets as all deeply in the red after the UK tax cut plan and more fear of recession. A couple of US economic new releases today. Keep an eye out over the next few days for a technical note.

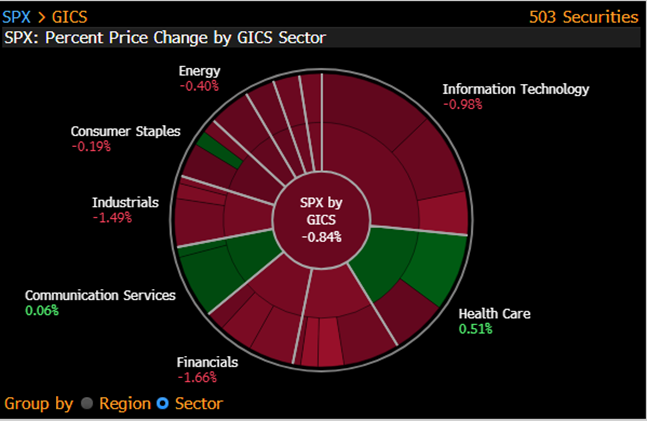

Yesterday’s price action hit almost everything with only healthcare and Comms ending in the green.

Downward movement yesterday pushed the averages closer to their June lows, with the DOW just about 450pts away from a new low, SPX 122 pts away and the QQQs 11pts away. Everyone has been talking about this recent pullback like it was a rapid and quick blip, but the rally peaked in mid-August, and we have resumed the downtrend for over a month. If this was simply a brief pullback, we would have expected it to be over by now. I fear that I am beginning to sound like a broken record, but the internals are deteriorating further. Internally yesterday we saw Adv/dec of -4.7 to 1, 72% of SPX stocks at 4wk lows, 89% of stocks below their 50dma, and 80% of stocks below their 200dma all confirming that the market is weak just about everywhere you look. The put/call ratio is staring to tick up but nowhere near typical bottom levels, we are watching it though. The AAII bear/bull survey showed that 60% of survey takers are bearish, this is usually a contrarian indicator that it is time to buy. However, we are reminded that this is what people are saying not doing. Looking at the COT, most investors are still net long the SPX and NASDAQ. The retail investors are also still in the buy the dip mentality with ETF flows still positive in many areas of the market. We need to see both of these things be more bearish before we can believe the AAII survey. The market is looking a bit oversold, and any “good news” will likely trigger a short rally.

Market news: Yellen said that the 2% inflation target may not be met in 2023. Goldman slashed its year end target from 4,300 to 3,600 citing higher interest rates. The UK made a bunch of radical moves to help their economy be more resistant to inflation including tax cuts and $67 billion to help with energy costs. The move sent the pound down 2%. While this may help some citizens in the near term, tax cuts and fuel subsidies seem like it may lead to a longer period of inflation. The market has priced in 100bps hike at their next meeting. Russia said that their nukes can be used to defend annexed Ukrainian regions sending fear through the world that Putin may take this invasion to the next level. Referendums for some of these regions have begun. There are lines of cars stretching 25km out of Russia as people try to flea before their family members get drafted. Manhattan rents are starting to flatten out after consistent increases for the last 6 months. US state department said they have hit a will with the Iran deal, not surprising. Sri Lanka is considering taking on more debt from India and China in a attempt to expand their solar energy capacity, the country has been struggling for most of the year. DeSantis is being sued for the immigrant planes that were sent to Martha’s Vineyard. FDX is raising their shipping rates. Credit Suisse is considering splitting their bank into multiple parts and exiting the US market. Costco earnings were solid, but the stock is down pre-market. Hurricane Tracker: Fiona is out by Bermuda and will head straight north into eastern Canada and sending big storm swell through northern New England. We got a tropical depression north of Venezuela that is heading right over the Bahamas, Cuba, and into Florida, watch out. Two small storms in the mid-Atlantic. Newton in the pacific is heading out to sea.