“You may not realize it when it happens, but a kick in the teeth may be the best thing in the world for you.” Walt Disney

Yesterday: Always a good day when DOW, S&P, and DOW all end in the green. Even better when it’s back-to-back green days across the board. The ECB rose rates by 50bps which was not too surprising, and markets mostly likes the decision. TSLA ended the day up over 9%, helping to give investors the courage to buy more growth names. DHR’s earnings helped to give MedTech a boost. Earnings so far have not been so bad. Better than we expected, we must admit. Weaker than a normal earnings season but not as bad as you would think while on brink of recession. There are cracks, however, in names such as SNAP, which is down 28% this morning. Certainly not the best print last night but missing the guidance they gave a month ago, and pulling forward guidance is a recipe for disaster. Energy was one of the worst sectors yesterday, investors seem to be digesting the inventory data on Wednesday, the possibility of demand destruction, and the Nord Stream coming back online. Regarding the energy trade, we still think that unless this is a severe global recession, E&Ps are discounted far too much. While we are not trying to forecast the degree of a recession, we believe that the oil trade is not over. A negative trend across most E&Ps, but we believe these oversold conditions are an opportunity to buy (make sure to buy quality). Biden tested positive for covid yesterday, full vax & 2 boosters, I guess you can’t hide anywhere (he is feeling well). Initial jobless claims and continuing claims both edged higher yesterday and continue to climb, this isn’t a good look for the economy but might be what Powell is looking for. Bloomberg reported that their survey of economists sees Powell slowing his rate of hikes after the 75bps at next week’s meeting.

Today: Mixed premarket, DOW FUT up 0.17%, S&P FUT down 0.11%, NAS FUT down 0.2%, Oil continues to pull back down ~1%, US 10-yr down 10bps @2.805%, 10y2y still inverted. European indices are in the green and APAC is closed in the green. Eurozone Composite PMI came in at 49.4, anything below 50 indicates a contraction. US PMI out at 9:45. Coinbase is in a fight with the SEC about insider trading. The German government has agreed to a deal to bail out energy giant Uniper. There have been high geopolitical tensions across the globe, beyond Russia-Ukraine, the South Korean president said North Korea may be ready to conduct a nuclear test soon, and explosions were reported in Damascus and Syrian air defenses intercepted Israeli missiles. Nancy Pelosi is planning a trip to Taiwan in August, this is the first time the speaker of the house has visited the country in 25 years. Chinese political experts are saying this alone could spark an international conflict between the US, China, and Taiwan. AXP (+4% premarket) reported record revenue and raised guidance. VS (-4% premarket) reduced guidance and missed EPS expectations. SNAP down ~30%.

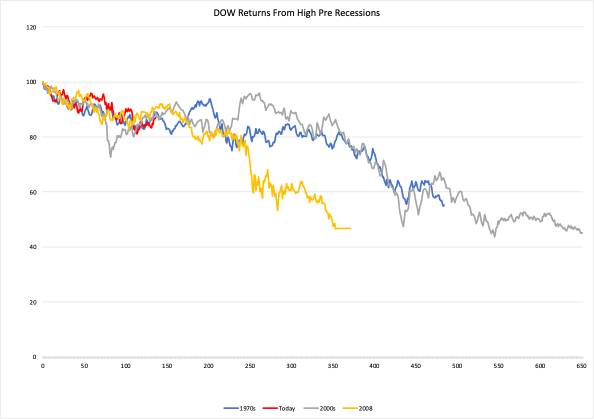

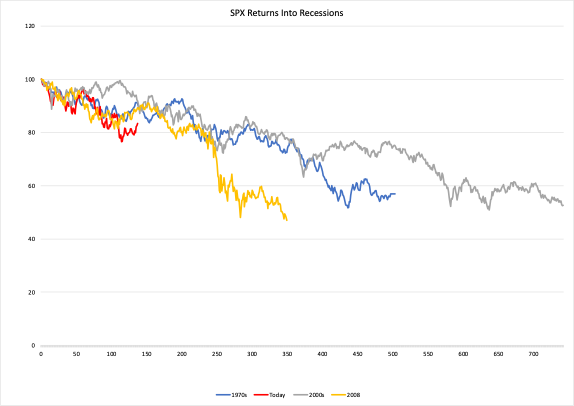

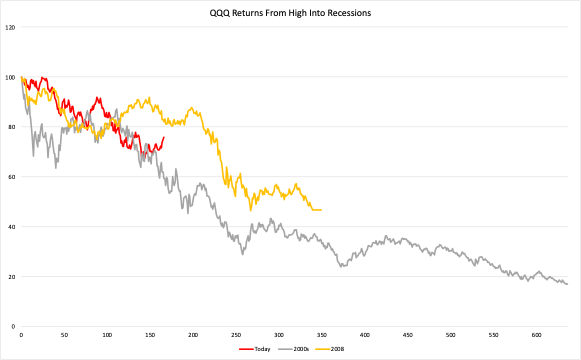

Today we take a look at history. We are not saying that this is the future tragectory for the indices, but we think it is important to look at what history has done to prepare for the worst. Here we look at the performance of S&P, DOW, and QQQ from their highs into recessions. They were all indexed to 100 at the time of their high and the charts end at or near the market lows. Please note that the QQQ data was not available in the 1970’s. Let’s take a look.

The first one we look at, the DOW, seems to be tracking the 1970 bear market quite closely. A time of high inflation and a battle to raise rates to combat inflation, aka similar to today. We are about 140 days into this drawdown, history shows it could go another two years… a scary thought.

The second one we look at is the S&P. The bear market tracked quite well with ’08 and the 1970s but took a deeper drive just about a month ago. Important to note how large these bear market rallies have been in the past. In ’08 there was about a 20% rally, same in 2000 and the 70’s. Right now we sit around a 12% rally in the SPX. Same as the DOW about 140 days into this drawdown, could be 2 more years.

Finally, we look at the QQQ. It doesn’t track history quite as well as the other indices but the message is there: bounces happen, bear markets can be long and it is painful.

Top 5 Picks

Sysco Corp (SYY)

Booz Allen Hamilton (BAH)

Molson Coors (TAP)

DoubleVerify Holdings (DV)

Etsy Inc (ETSY) – Overtook ORLY

On the road M-W next week. No notes those days.