Been on the road this week – morning updates coming back today.

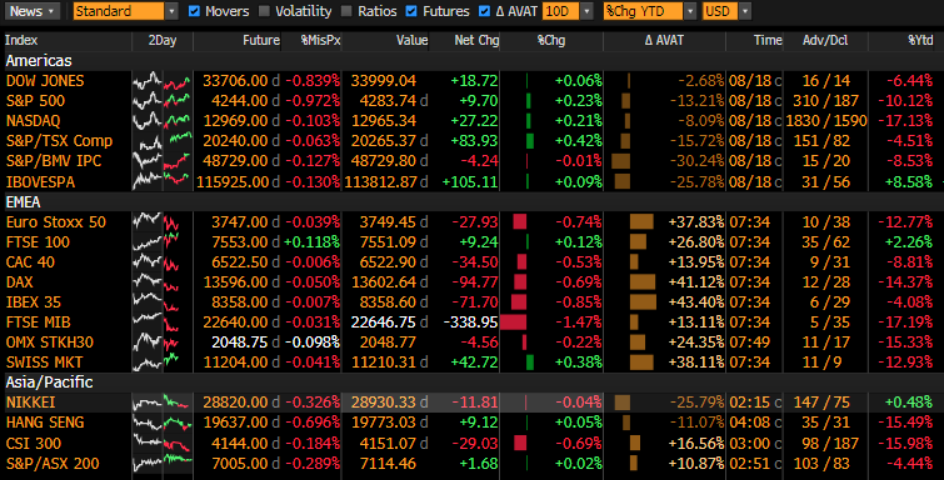

Futures are heading lower today which is set to break to S&Ps 4 week winning streak. DOW FUT down 0.82%, S&P down 0.99% NAS down 1.10%, Oil pulling back 2.33%, Gold down 0.4% and the US 10yr up 6bps @2.94%. Crypto is crashing this morning with BTC down 8.4% and ETH down 8.96%. Seems like the risk apatite is drying up.

Yesterday we saw a pretty mellow day with all three indices ending in the green, but on light volume. The conversations continue to be focused on what the Fed will do with the conflicting economic data. Jobless claims came in yesterday light of expectations indicating that the tight labor market might be more resilient to higher rates. The Phili Fed Business outlook came in higher than expectations signaling expansion in the region. Housing data has been dismal. Housing starts MoM down 9.6%, Existing home sales down MoM 5.9% and mortgage applications down 2.3%. The Fed minutes that came out earlier this week only added to the confusion, a blend of higher rates and some dovish comments. It seems like Powell has learned that telegraphing one thing too hard (the transitory talk) isn’t good. The speech next week from Jackson Hole will be an important one, until then its anyone’s guess.

Yesterday the news, Twitter and just about everywhere couldn’t shut-up about BBBY and Ryan Cohen. The stock that was up above $25 from less than $5 a month ago has crashed back to $10 after Cohen sold all his stock. We learned that BBBY has hired Kirkland & Ellis to help address their large debt issues, Kirkland is best known for restructuring and bankruptcy cases. The stocks only go up crowd is still out there and it appears to us that this is exactly what the Fed wants to go away. DE’s earnings missed expectations and lowered their guidance on a weaker Ag outlook. Tough farming conditions are hurting the industry worldwide, we have been talking about a shortage of food in some counties and it seems the issues are not over yet. Germany’s largest refiner (operated by Shell) is reducing the output do to the low water levels of the Rhine River. Looking ahead the water levels in the Rhine are expected to rise next week, hopefully ending the dangerously low levels and opening more shipping along the river. Venezuela is suspending oil shipments to Europe, likely to add to the energy crisis on the continent. Putin is apparently going to be attending the G20 summit in Indonesia. China is not happy with the new trade talk between the US and Taiwan. Russia and China are conducting military training drills together. The geopolitics saga continue. There is a current storm brewing in the Gulf and its looking like a 40% chance of turning to a cyclone, stay tuned for hurricane season watch. $2.1Tln of options expire today which could add to some sticky price action on the S&P.

On the technical front the percentage of stocks within the SPX is above 90% and there has been a 50% retracement, historically indicating that the bottom has been put in. We have been looking for these indicators to better help us but we are now sitting here considering that the conditions today might make the indicators not as reliable. First, the majority of the indicators occurred during a neutral or a QE period not a QT period. Second adding valuation into the mix, the famous “Rule of 20” indicates that we still have time room to fall before the bottom is in. Finally, the market is heading into some of the worst months for performance. The bottom might be in but we don’t think in the near term (3 months) we will see new highs. The market was turned away at significant resistance, overbought and facing some potential hawkish Fed talk next week. Caution is your friend right now.

WHC TOP 5: PCTY, NET, ETSY, TTD, CROX