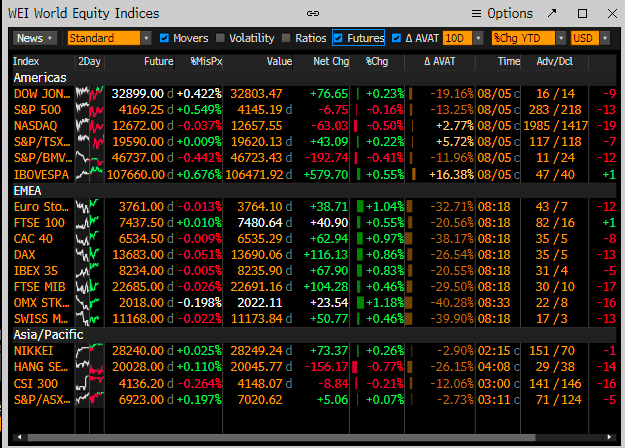

Futures are pointing to a green open today, DOW FUT up 0.42%, S&P up 0.54%, NAS up 0.69%, Oil sliding 1.03% on demand fears, Gold up 0.6%, and the US 10yr down 3bps @ 2.8%.

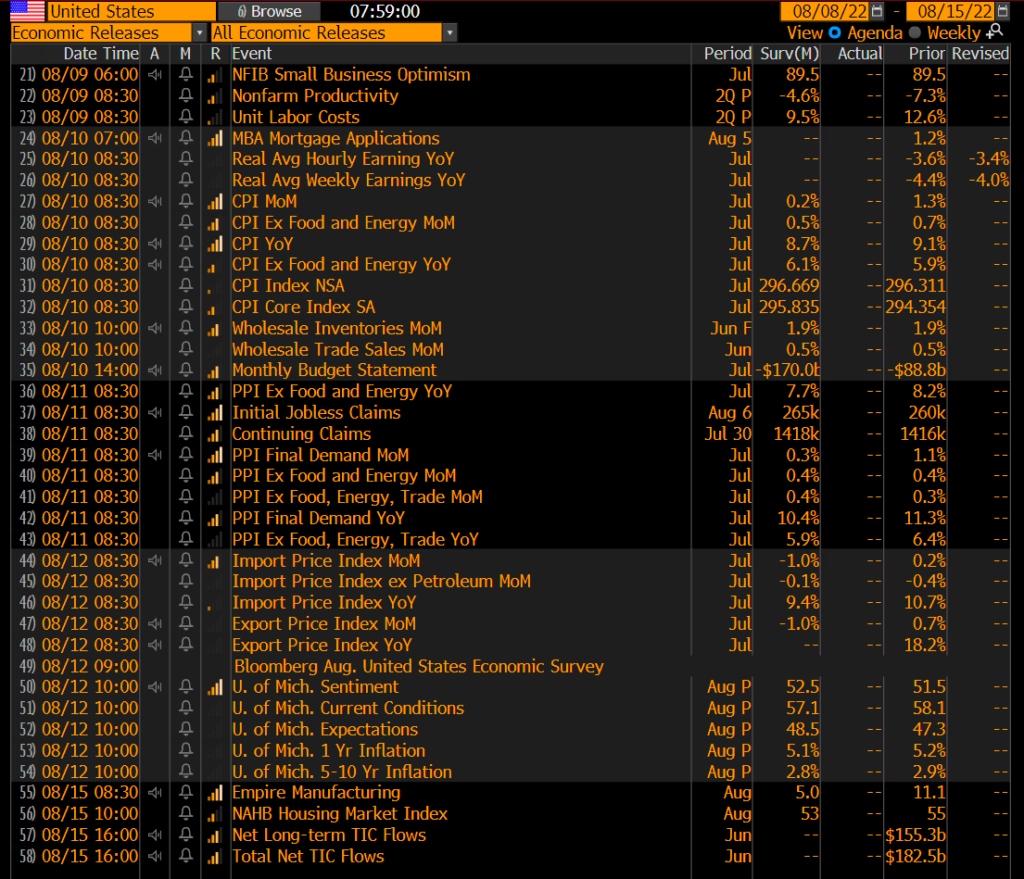

We saw a lot of movement in the markets on Friday after the banger job numbers came out. The US has recovered all jobs lost since COVID and unemployment has returned to 3.5%. The initial reaction was just as we expected, a sharp decline in equity markets and rates jumping. Throughout the day, the market pared most losses and the DOW ended in the green. We were a little confused, either investors just don’t care that there will be more rate hikes or they are assuming that this data is backward-looking and that the job market is going to get worse leading to a fed pivot. This week will be big with the CPI numbers coming out on Wednesday. Many banks are writing about peak inflation and Goldman published a report titled “Disinflation Ahead”. We might have seen peak inflation, but we doubt any decline will be enough to justify a fed pivot at this point. Still see the pivot coming in early 23. See the economic calendar below.

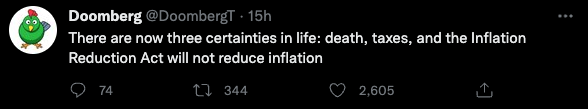

Soft Bank posted a huge quarterly loss, their Vision Fund lost $21.6B in the quarter as the pullback in tech stocks hit them extra hard. Pfizer is buying Global Blood Therapeutics and CVS may be buying Signify Health. China announced that they will conduct more military drills around Taiwan. Russia recently shelled the area around a nuclear facility which caused many to call for a humanitarian quarter around nuclear sites. A non-Ukrainian ship has landed to receive a shipment of grain, the first international ship to do so since the war began. The French Farmers Union warned that there might be a Milk shortage this fall/winter because of the lack of feed. The UK is expecting citizens to pay ~300 gbp for electricity in October. To combat this, over 75k citizens have signed a petition that they will not pay their bills until prices go down. Stay tuned to see what happens to these 75k people. The Senate passed the Inflation Reduction Act which came as a victory for the Democrats, the vote was 50-50 with Harris casting the tie-breaker vote. The bill seems like just another way to spend more money the government doesn’t have. See this tweet that we thought deserved a chuckle.

Internally, we haven’t seen anything that really screams that the bear market is over. The SPX percent of stocks above their 50ma is on the decline after maxing out at 75%. Additionally, stocks above their 20dma have stalled around the 80% level. A level the SPX has not been able to clear during every rally in this bear market. The 10dma AD line was making good momentum but has since pulled back. New lows are still exceeding new highs. The leaders on Friday were many of the winners that we have seen this year, energy lead the charge. The SPX Is stalling around its 150dema. Not enough sustained breadth in the market during rallies, we will keep an eye on it.

WHC TOP 5: PCTY, EXTR, ESTY, CROX and NET