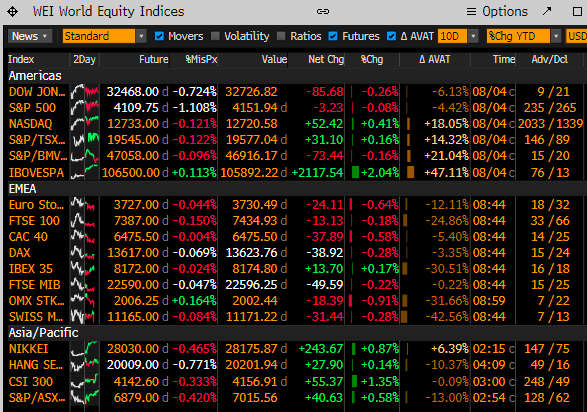

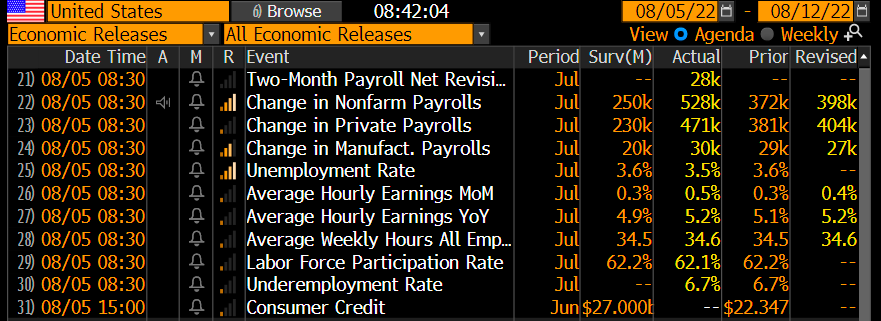

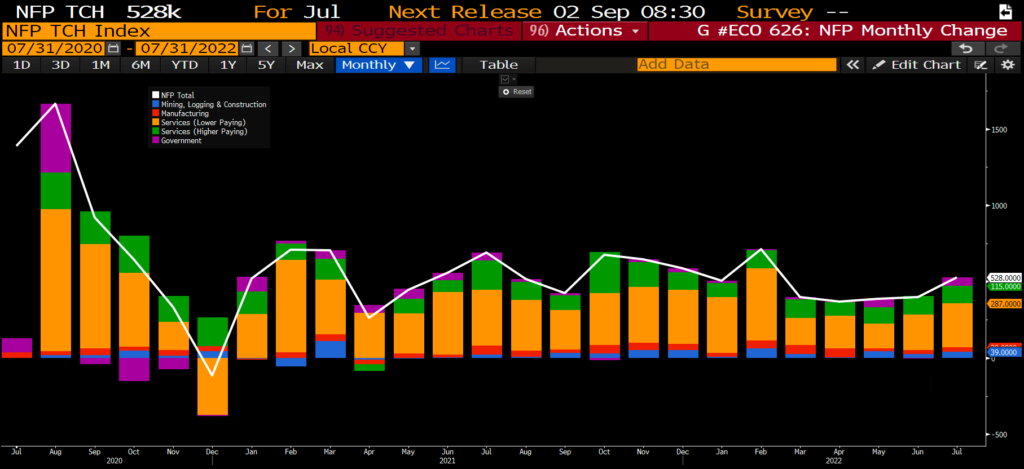

The markets took a quick dive this morning after a very tight trading day yesterday. Futures are ticking down, DOW FUT down 0.62%, S&P down 0.96%, NAS down 1.3%, Oil down 0.1% and below $90, Gold down 1%, and US 10yr up 12bps @ 2.8%. Job numbers shattered expectations, and the unemployment rate decreased to 3.5%. Bonds jumped on these good numbers and the swaps markets have priced in a 75bps increase in September. Not surprising, after the past week of Fed presidents talking about more hikes.

All was pretty quiet today before the job’s numbers came out. Senator Sinema has signed off on the Reconciliation bill after saving the carried interest loophole. In this bill is a proposed tax on stock buybacks. Not sure what the details are of this but certainly could be negative for stocks since this has been a favorite way for companies to improve shareholder value. There have been civil unrest and protests in the UK about the high cost of living, at the same time they said inflation has not peaked and that they will be going into a long recession. Spain is implementing an A/C minimum at 80º F and putting a fine of $60k-600k for violators. AMZN is buying Roomba maker, TSLA is doing another stock split, and META issued 10bln of bonds.

Price action will be important today for the major indices. QQQ has been hanging in-between the 150 & 200dEMA and is nearing overbought territory, DOW has been topped below the 150dEMA for about a week, and the SPX has been trying to break above the 150dEMA but can’t close above it. The SPX has an RSI of 65, a level that it has not been able to surpass on every rally attempt YTD. Today should tell us if we can break out of this range or if this is indeed a failed rally. Based on the action this morning it seems like this level will act as resistance.

We wanted to look at a couple of things this morning. We have been talking about the change over the last month or so from the YTD laggers becoming the month winners. This looks to us more like a bear market rally than anything else but we wanted to look at a few stocks that may provide a look at sentient. The first is HKD, a Chinese software company with a current market cap of $150B and $55M in revenue. The company had its IPO on July 15th, 2022, with a market cap of $3B. The stock peaked at a market cap right around $600B just about a week ago. The second stock is the infamous AMC. They recently announced they are going to issue preferred stock under the ticker APE. This attempt to raise money will likely work and it’s not a horrible move for management. Both these examples show that the speculative investor that is just buying anything is still out there. The sentiment is too bullish in these areas of the market. It is possible that it is sustainable but we expect that we can’t have a real bottom in the market until these areas of speculation are squashed out.

WHC top 5, CROX, EXTR, ETSY, PCTY and EQT.