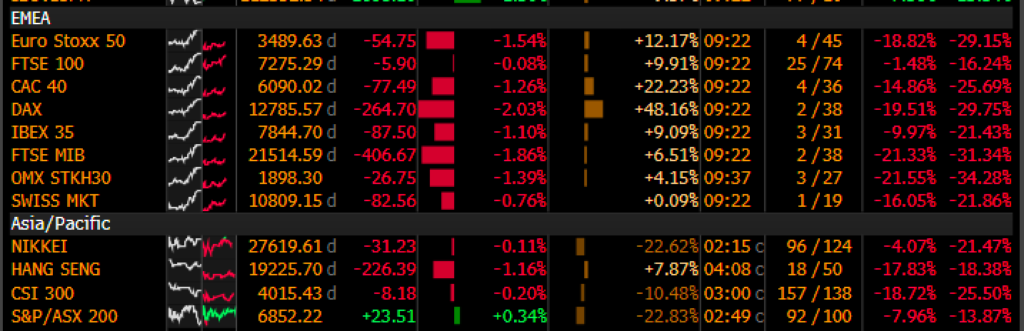

Happy Labor Day! US markets are closed today. European stocks are getting hammered this morning after OPEC’s decision to cut production by 100kbpd. Asian markets closed mostly in the red.

The price action on Friday was a roller coaster. The jobs report had some areas of strength and weakness. Wages were lower than expected, and unemployment rose from 3.5% to 3.7%. However, the participation rate rose and new jobs were higher than expected, although lower than July. It wasn’t overly surprising that the day ended in the red. The jobs report was more or less in line with expectations with only a few glimmers of slowdown. Something that we have been saying over the last few months is the Fed needs to see major changes in the inflation rate or in the economy to warrant a pivot. Powell has made it very clear that he does not want to have a stop-and-go policy indicating that little 0.2% change in unemployment won’t change his mind about more rate hikes coming. The market has continued to deteriorate from within. New highs to lows was -5 to 1 with less than 35% of stocks in the SPX above their 50dma the pullback has been rapid and broad. Unless we see repair from within, we think the next move will see the market testing June lows.

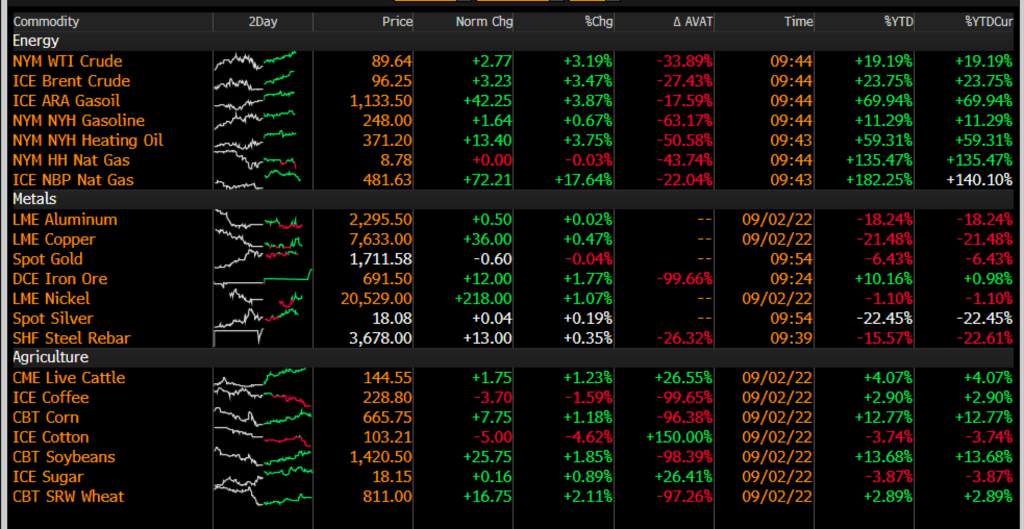

The big thing this morning was OPEC’s decision to cut production by 100kbpd. The move was not unexpected, as they have been telegraphing something like this for a few weeks now. The decision sends WTI and Crude up more than 3%. OPEC currently is sitting in a place of great power and they are starting to play their cards. Low gas prices have been key for the Biden administration entering November elections, this move will likely be a blow to the dems just months after Bidens visit to Saudi Arabia.

The energy crisis in Europe has worsened after the Nord 1 is on hold again to repair a “leak”, Russia stated that they will stop critical gas supply to Europe until the West lifts sanction,s and finally Germany is set to miss critical gas storage milestone. All of this in combination with the OPEC news sent euro nat-gas higher as much as 20% this morning. The commodity trade has come back as the gravity of the food and energy global crisis begins to sink in.

Market News: All eyes are on the 13th, when CPI data will come out. Liz Truss was been elected as the new PM of UK and she is expected to sworn in soon. She will be announcing her plan to get the UK more prosperous and part of this includes cutting taxes. More fighting in Tripoli is adding some concerns about Libyan oil production. Las Vegas, New Mexico (not the casino Vegas) has about 20 days left of fresh water. Lake Powell fell to its lowest level since the 1960s. Hurricane tracker: There is a hurricane heading towards the UK, and a tropical storm off the Bahamas headed towards the middle of the Atlantic.

WHC TOP 5: CEG, EXTR, CROX, PCTY, TTD