The final day of August greets us with a yawn as market futures modestly push upwards this morning with the S&P +0.29%, Nasdaq + 0.69%, and Dow +0.13% after yesterday’s selloff which left all three indices down ~1%. WTI continues its downward pressure down 2.9% after falling 5.5% yesterday.

European indices are trading in the red after Euro Zone inflation hit a blazing 9.1%. The energy narrative in the EU continues to deteriorate with Russia closing Nord Stream 1 for “maintenance” beginning today and concluding on Saturday. This completely cuts off Russian gas flows to Germany during the maintenance and exacerbates the troubling energy outlook in the EU, especially were the Nord Stream 1 to need “extended maintenance.” Reports are coming out in the EU of energy bills skyrocketing and causing some small businesses to close. As we approach the winter we can’t help but think about the broader EU economic implications as a result of these astronomical energy bills. We will be looking for areas of short exposure to take advantage.

ADP Employment came in +132K vs consensus +275K as a preview for Friday’s headline payroll growth. As a reminder expectations for Friday’s print is +300K, down from July’s +528K. Employment is in the FED’s spotlight as a strong print would give another data point to support a +75bps hike in September. SNAP is laying off 20% of its workforce, BBBY is plunging to the avail of the retail trader, and US regulators will begin auditing Chinese companies next month.

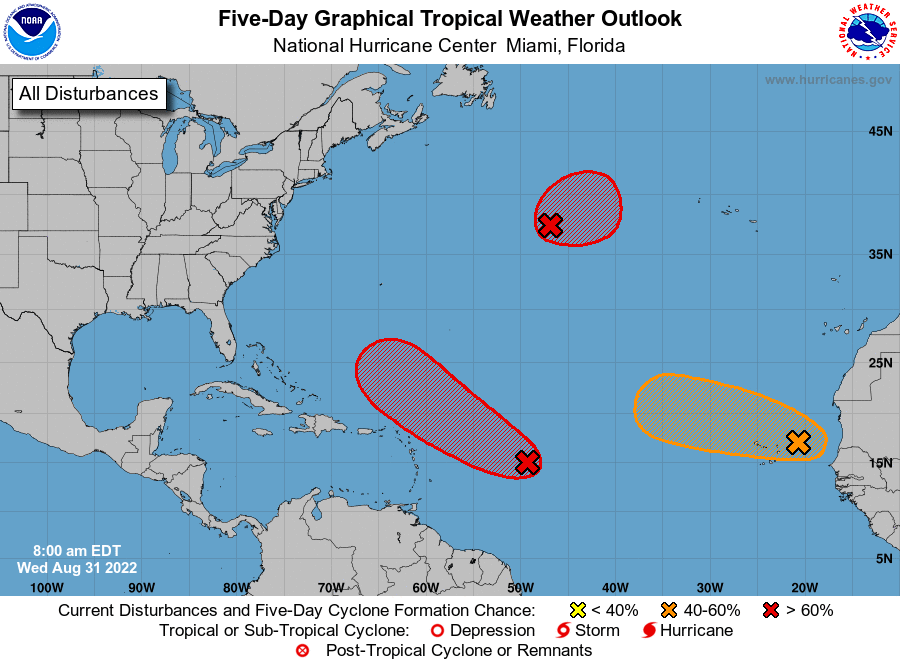

The hurricane tracker shows a strong chance of a formation over the next 5 days and is something we will be tracking.

A final word to our readers, September begins tomorrow which historically has been the worst month for equities. History doesn’t repeat itself, but it often rhymes.