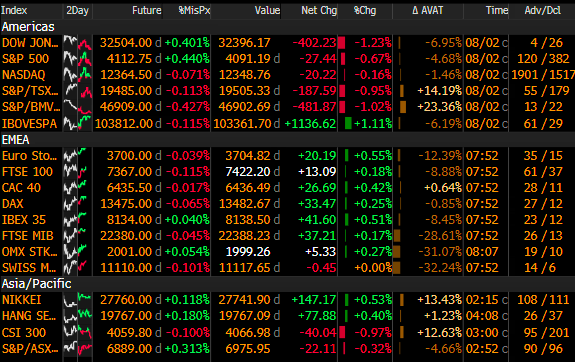

Futures rise after back to back losses, DOW FUT up 0.43%, S&P up 0.45%, NAS up 0.44%, Oil up 1.2%, Gold down 0.45%, and US 10yr up 4bps @ 2.79%.

The market tried to rally yesterday after Pelosi landed in Taiwan and met with officials. The initial reaction was positive sending markets but after digesting an enraged China, they ended in the red. China is going to be conducting military drills around the island and reports indicate they are within Taiwan waters. So far it seems like these drills are just a way for Xi to save face, but they could escalate into something more. The inflation reduction act looks like it will make it all the way through, but this bill seems like a way to help the consumer to continue spending, prolonging the inflationary pressures. Over the past 24 hours, we have seen at least three fed presidents say that they will continue to raise rates and 50 or 75bps are likely in September. Currently, Bullard is on CNBC saying they are not done raising rates, and they are watching the data carefully. In the long term, history would suggest that they won’t reach their goal of squashing inflation until fed funds are higher than inflation. The Rhine River, which we mentioned a few weeks back, is dangerously low and centimeters from causing shipping disruptions. Another point of pain for an already struggling Europe. Monkeypox has been spreading and worldwide numbers have surpassed 21k. Still, pretty tame compared to COVID but California declares a state of emergency over the outbreak. They join Illinois and NY in the states that have done so. Pfizer board member, Gottlieb, predicted that monkey pox will be a public health failure.

There is some more data coming out today that might give a helpful look into the health of the economy. Mortgage applications inched higher for the first time in a while. OPEC supposedly increasing production by 100,000bpd.

Tough day for two names in the WHC top 10 model, TAP -10% and SEDG -10% after hours. Earnings can really be a make-or-break, both out of the top 10 in the model.

Top 5 – CROX, ETSY, BAH, EQT, EXTR

Couldn’t get to the technical note yesterday, look for one today.