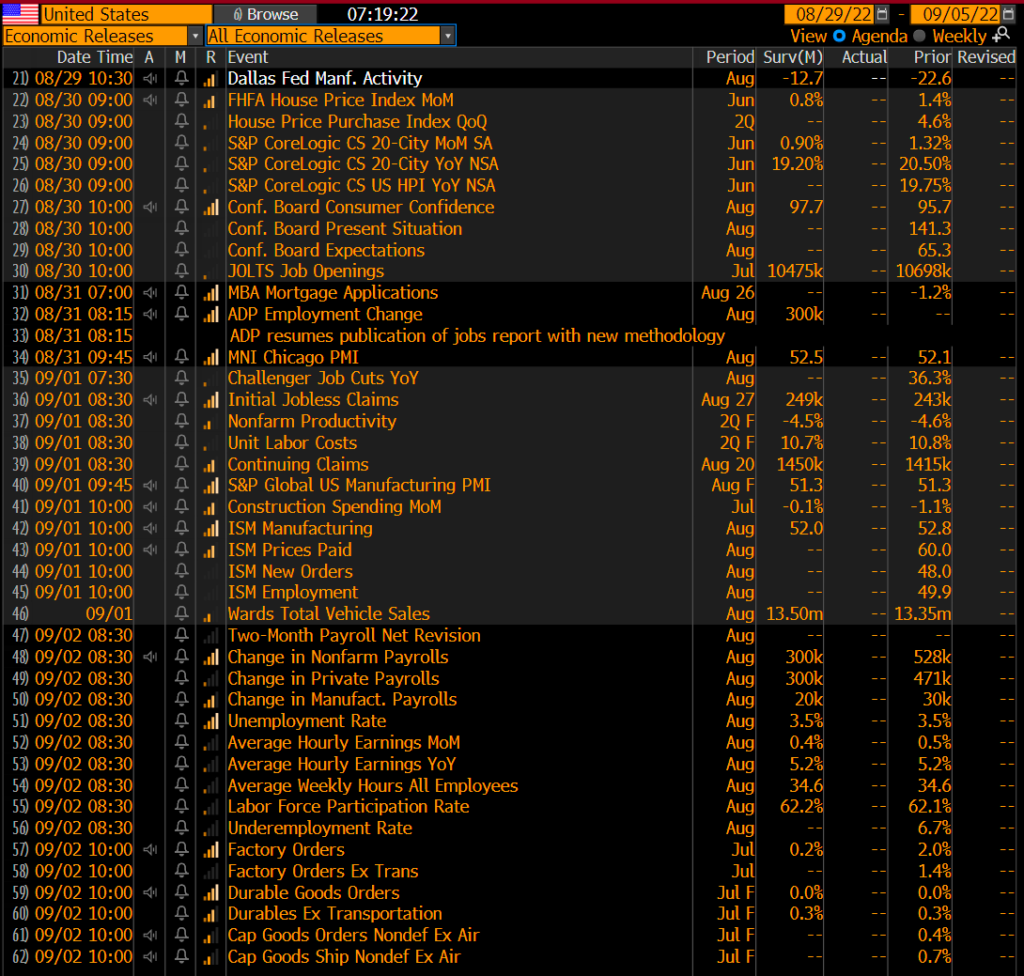

Looking like another gloomy day in the markets. Futures are under some significant pressure today, DOW FUT down 0.75%, S&P down 0.81%, NAS down 1%, Gold down 0.45%, Oil up 1.2% and the US 10yr continues to tick higher by 5bps @3.09%. Asian markets were pretty tough ending mostly in the red. Europe is red across the board after digesting Friday in the US markets and poor GDP numbers out of Sweden and poor retail news out of Ireland. Busy week ahead for economic news in the US.

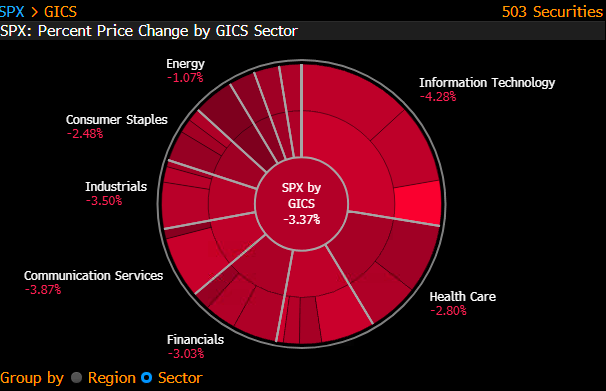

Friday was a bloodbath, little or nowhere to hide with every sector down >1%. Going into the meeting we were either expecting something big like Friday or a day with little movement. Powell said virtually what was expected, not dovish but not overly hawkish. Their goal of continuing to raise rates until inflation goes down and not making the mistake of stop-and-go policy has been something that has been telegraphed for some time now. While his commentary was not surprising, we were surprised with the 3% pullback in all major averages, a clear indicator that investors were expecting a real dovish Powell and a pivot after one month of decelerated inflation. Always important to remember don’t fight the FED. The internals was sending the message that the rally was losing steam, lower volume, rejection at the 200dma, more lows than highs, and a deterioration number of stocks above their 50dma. Friday’s internals continued to deteriorate, with the market closing below the 100dma, higher than average volume on a down day (bad), NYSE Adv/Decline -14 to 1 and new 52w low: highs almost 3:1 on the NYSE.

We want to highlight a few sectors that we have been watching. The SPX Energy index outperformed the S&P by about 200bps on Friday and has been flashing strong internals with bullish implications. The percentage of stocks above the 200dma is currently 95% (100% on Thursday), and the sector is hovering around overbought conditions. While entirely possible a pullback will come from these conditions the breadth of the sector is unmatched and we expect the sector to continue ticking higher. On the other hand, the S&P infotech and discretionary sectors are sending sell signals. Couldn’t break through the resistance level at the 200dma and the percent of stocks that are above their 200dma is minuscule. We continue to like energy and would sell tech/discretionary on any strength.

Market News: Netflix is considering $7 for its ad subscription. Both the food and energy crisis are not showing any signs of improvement and are gaining traction across various new websites. Euro Nat Gas fell after a huge week of gains. NASA is launching a huge rocket today, although they are troubleshooting problems and the launch is being pushed back but not canceled yet. Bitcoin dropped below $20k again. Ukraine has begun a new defense in the south. Hurricane tracker: 2 storms brewing in the Atlantic, one with a 40-60% chance of becoming a cyclone and one with a low chance of turning into anything.

WHC TOP 5: CEG, CROX, NET, PCTY, TTD