Today is the day that everyone has been waiting for. Powell speaks at 10am today and everyone will be waiting to hear what he has to say, more of that later. Markets are lower, DOW FUT down 0.14%, S&P down 0.27%, NAS down 0.35%, Oil gaining 1%, Gold down 0.84%, and the US 10yr continues to tick higher 4bps @3.07%. Asian markets were mostly in the green, the opposite is true for Europe with most indices in the red. Some more economic data will come out before Powell speaks today, likely too late for him to have any data change his mind but it’s worth watching.

Yesterday was a solid day with the SPX and NAS closing up more than 1% and the DOW closing up just shy of that. We are starting to see come positive internals returning. The percentage of stocks above their 50dma is rising, new highs were higher than new lows yesterday on the NYSE (the same is not yet true for the NASDAQ), and momentum is beginning to turn positive. However, volume remains quite light. Understandable heading into the Powell speech today, but we need to see some higher volume to confirm a rally has power behind it. We wanted to call out the Utilities sector. While it’s not surprising that a defensive sector would have held up this year, the equal weight index is set to break out to a new high. It has performed quite well relative to the equal SPX and is nearing a significant resistance level, while nearing overbought conditions we like this trend. While reviewing charts this morning we noticed a very common resistance level across dozens of the stocks we follow, the rally ended at their 200dma. This isn’t super surprising since many of the stocks are in the SPX and have a high correlation, however, it does show the depth of the bear market bounce resistance. Below are a few examples.

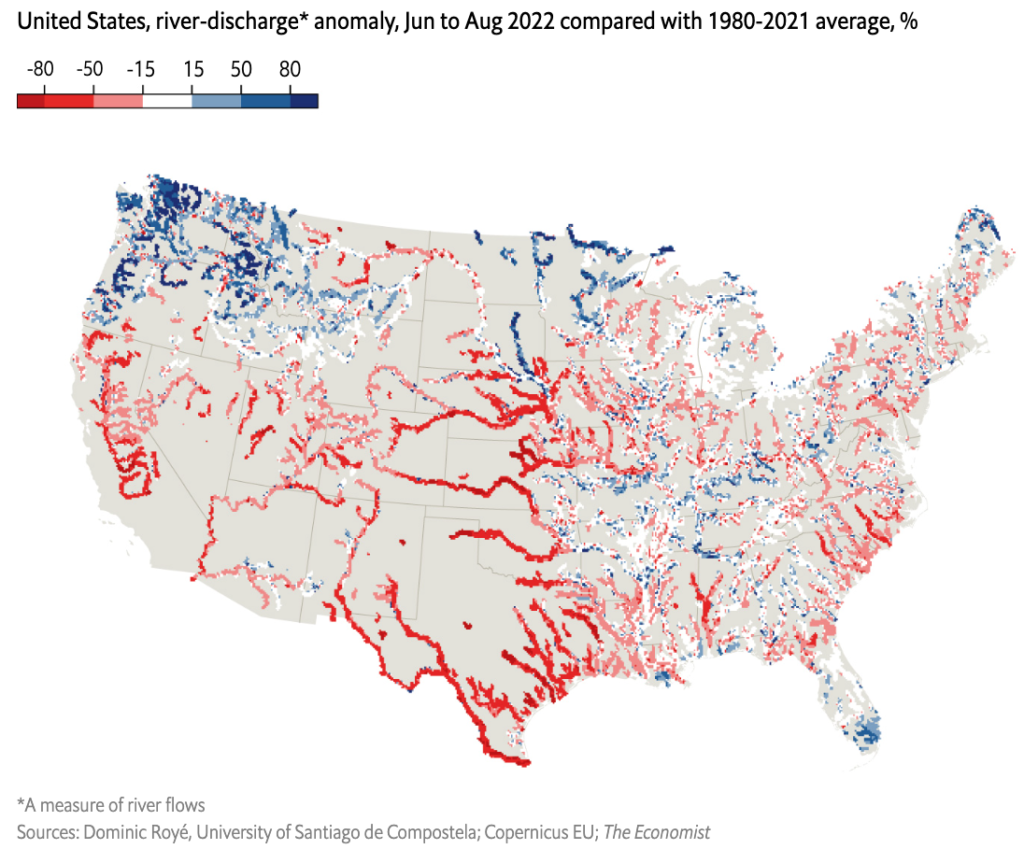

Market News: Basically, the only thing people are talking about today, and this week, is Powell. The market has been holding its breath waiting for some indication of what the Fed will do. Yesterday we noted that the Fed presidents have been telegraphing that they want higher rates and more front-end loading, which is what we see happening. However, we wonder if Powell will not make any meaningful moves today. Powell almost lost all credibility last year with his transitory call, and he doesn’t want to make that mistake again. We think the odds of him being fully dovish are extremely low, being neutral is a way for Powell to stay flexible without scaring the markets too much. Beyond Powell, much of the news continues to be focused on energy. Prices are rising to records across Europe and residents are struggling to pay their bills. The Czech president stated that he is afraid for the energy crisis, Spanish officials were warning of a winter of great suffering and many more countries are sounding similar alarms. Beyond the energy crisis, there continues to be a water shortage across the world. According to the economist, Europe is at its worst drought in 500 years and in the US much of the southwest is in deep drought.

In China, the lack of water could send pain across the world. The above-ground and groundwater levels are dropping to dangerous levels. Their grain is a serious risk as farmers are watering faster than the water levels can be replenished. Foreign affairs reports that 60% of wheat, 45% of corn, 35% of cotton, and 64% of China’s peanuts are grown in the region that comes from the most at-risk region of the country. If this continues the potential of higher grain prices becomes a certainty. California voted to stop the sale of combustion cars by 2035. Biden announced that the govt will cancel student debt for certain individuals, which may cost the US govt up to $360B. This move caused an uproar from both democrats and republicans as the move appeared to be without much thought for the consequences. Hurricane tracker: Still those 2 same storms that have <40% chance of becoming cyclones off the Gulf. We are only a few days away from the end of August, if no tropical storms emerge it would be the third time in the last 60 years there wasn’t a storm in August.

WHC TOP 5: CEG, CROX, NET, PCTY, TTD