Futures are green this morning as markets are trying to get a second day of gains ahead of tomorrow. DOW FUT up 0.36%, S&P up 0.64%, NAS up 0.79%, Oil is adding to its recent gains up 0.55%, gold up 0.76% and the US 10yr up less than 1bps @3.1%. Asian markets were higher and Europe markets are choppy but in the green. More economic data is out this morning. Energy was the winner yesterday and we think that this trend is likely to continue.

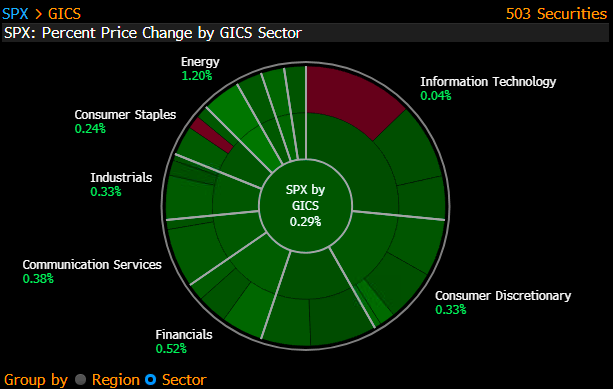

The market action has been rather benign, it is a true wait-and-see environment. The SPX dropped below a previous level of support and previous consolidation zone. Very possible that this level will become a key resistance level doing forward. Volume has been relatively low adding to the confusion of which way the market wants to go. In order to say we are at a bottom, we need to see much higher up-day volume. Maybe tomorrow will bring that. Energy has been making a solid bid recently and has broken out relative to the S&P. Long way to before it breaks its prior highs but the change is notable and we continue to like the E&Ps. The industrials relative to the SPX have sneakily made new year highs. While still down YTD this relative performance is significant and warrants more attention. Finally, consumer discretion has been breaking down and failed to break out of resistance level, sell on any strength going forward.

Market News: Kansas Fed chief said that the Fed has to get rates higher in the near term, other presidents have been sending similar messages. While Powell will ultimately be the one the market listens to, we think that these recent messages are foreshadowing what Powell will say tomorrow. While no one knows, our best bet is that Powell will indicate that the economy is fine for now and rates will go higher until inflation is much lower. Global energy still is top of mind. Experts are forecasting that ½ of UK households will be in fuel poverty by January. In China, multiple provinces are running low on electricity causing the movement to implement restrictions. EV charging stations are either being limited to off hours, lower output, or turned off completely. Not helping the transition to EVs. While grain exports out of Ukraine have begun to pick up significantly the world is still running low on many grains as the heat is killing crop after crop around the world. Grapes in Champagne are having to be harvested early this year or else farmers risk losing the crop to heat. Coffee plants are at risk of drying up in Brazil. We could go on but the bottom-line various foods are likely to be in short supply over the next few months into the winter. Oil continues to grind higher, building off of OPECs announcements of potential cuts and news that the Iran deal is going to fall through. The Zaporizhian nuclear plant in Ukraine is deteriorating. The Rhine river is drying up again and at risk of becoming impassable in certain areas. Reports are out that the raid at Mar-A-Lago came with direction from the White House, although the White House has denied this. Hurricane Tracker: two storms in the Atlantic have a small chance of becoming a cyclone.

WHC TOP 5: CEG, PCTY, NET, CROX, TTD