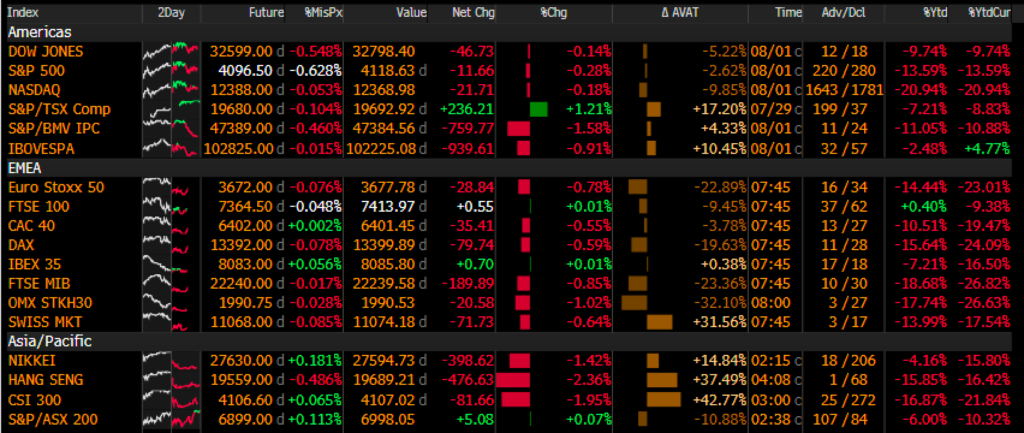

Markets are pulling back modestly, DOW FUT down 0.54%, S&P down 0.62%, NAS down 0.82%, Oil up 0.05% after the horrible day yesterday, US 10 yr down 4.8bps @2.557%.

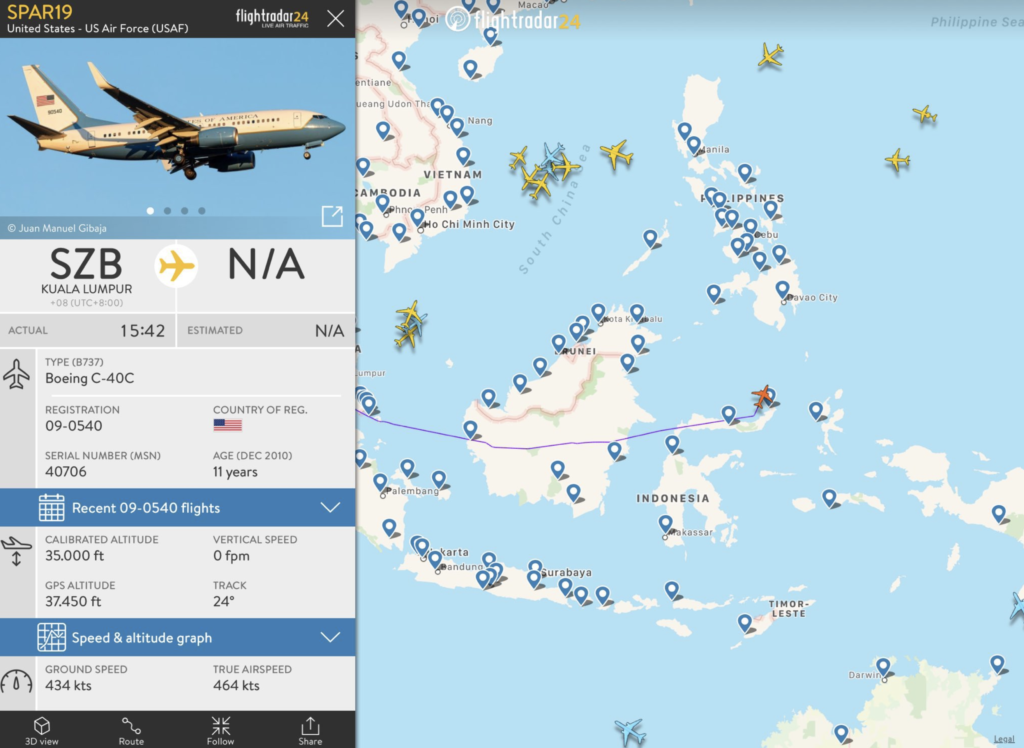

The news is all about Pelosi today and her visit to Taiwan. Reports indicate that China has sent warplanes to buzz the median and warships towards the median line of the Taiwan strait as a show of power this. This came when China said visits from Pelosi would undermine US-China relations and after they stated that playing with fire will get you burned. The US also deployed navy ships east of Taiwan, the likely direction her plane will fly. The plane likely carrying her, SPAR19, has recently turned towards Taiwan and will likely approach from the east avoiding the strait between China and Taiwan. They recently took down the live tracking of her plane after over 300k people were watching, here is the latest screenshot of her plan taking a turn towards Taiwan.

This reminds us of just a short while ago right before the Russian invasion of Ukraine, Putin made it very clear how against he was with Ukraine joining NATO. Following this, Vice President Harris said the US supported Ukraine’s joining. Shortly after Ukraine was invaded. Let’s hope this isn’t another example of the US causing a global conflict. If you think it will be one, buy protection with puts, possibly on semis and China.

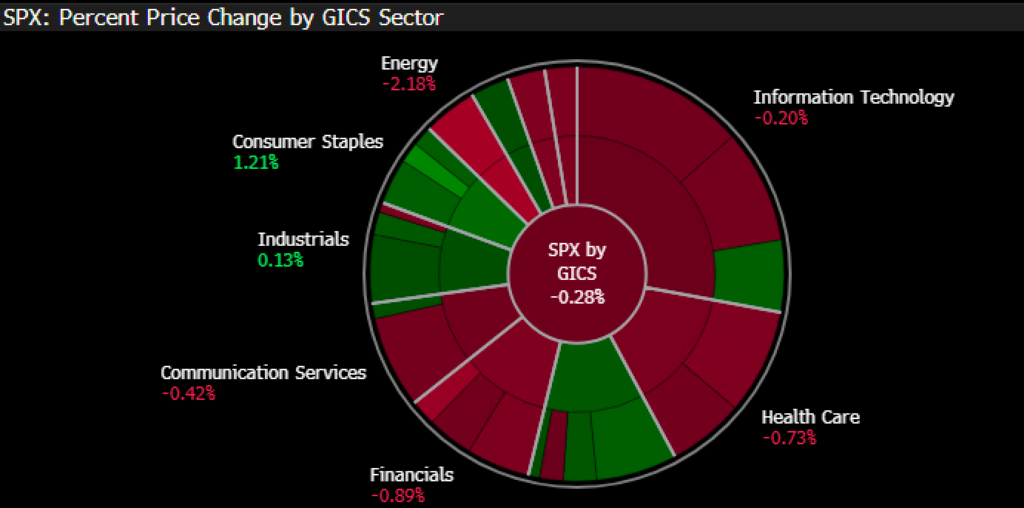

Yesterday was a pretty mellow day in the market, closing slightly in the red. Oil was down 5% yesterday causing, energy to be the lagger in the market as demand concerns are outweighing supply problems. OPEC meets tomorrow and will likely not have too much of a change in production following Biden’s recent trip there.

It was relatively quiet yesterday with investors contemplating the next fed hike and the geopolitical tensions. While many investors appeared to believe that the fed has reached peak hawkishness, we don’t necessarily believe this. While we see the fed pivoting in the late fall or early 2023, the recent commentary from other fed presidents about focusing on inflation rather than recession has us wondering if they possibly showed too much dovishness in their press conference. We think they will try to slowly take it back towards a more hawkishness tone in a way that won’t spook the market too much. Earnings have been solid, unemployment hasn’t risen too much, and the economic data isn’t great but inflation is still high. Unless we see a significant decline in inflation, or global tensions escalate we see no reason for the Fed to become more dovish in September. We see very likely another 50bps and if core inflation is above 5.5% we bet it will be 75 bps. Very little economic news today, in earnings we are watching SBUX, ABNB, TAP, and PYPL reach out for some ideas.

WHC TOP 5

SEDG

CROX

ESTY

ETQ

BAH

Keep an eye out for another Technical Report later today