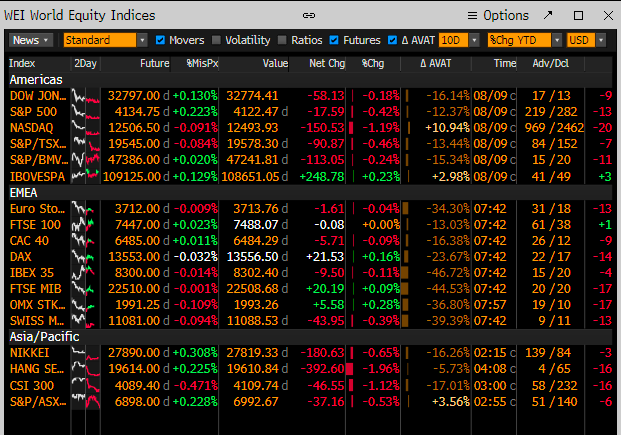

Today is the day that everyone has been waiting for, CPI numbers out at 8:30am. Markets have been stuck in a tight range over the past few days with today’s CPI print the potential catalyst to get markets headed in a more decisive direction. Equity futures higher with DOW up 0.19%, S&P up 0.26%, and NAS up 0.36%. Oil down 1.6% below $90 after Hungary agreed to pay for crude prompting Russia to turn the pipeline back on, Gold down 0.3% @1807, and the US 10yr quite flat @2.8%.

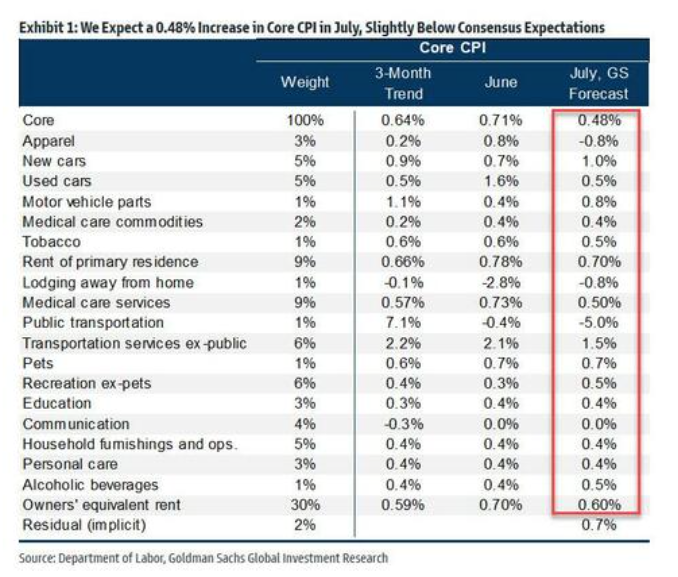

It is a big day for markets around the world today as everyone is looking at the US inflation number that will come out this morning. Headline CPI YoY is expected to be lower than last month, but Core is expected to come in a tad bit higher than last month. Below is GS expected increases for each segment of Core CPI.

When Headline was running hot, the Fed was discussing that Core is more important because they can’t control oil. With Core expected to be higher than last come and Headline expected to be lower than last month, we wonder if the Fed wills say that the rate hikes are working. It will be interesting if investors pay more attention to Core or Headline, will they buy the lower Headline or sell the higher Core number? Investors have been buying bad news and selling bad news this cycle making it has been hard to trade any data releases. A higher-than-expected CPI print will likely send markets down and an inline or lower number may signal to investors that the Fed has achieved its goal. While that may be the reaction today, we want to ponder the longer-term view that the Fed won’t have control of inflation until the FFR is at or above the inflation rate. The market is expecting that inflation will ease over the next year, but FFR still needs to be much higher than it is currently, and a high single-digit inflation number shouldn’t be acceptable for Powell. While Powell has made it very clear that they are data-driven we think that more hikes are ahead of us regardless of today’s number. On previous “bad” news releases, there was some politician telegraphing before the new releases that a bad number wouldn’t be as bad as people thought or that higher inflation was because of XYZ. We haven’t seen this yet. We don’t have a Ph.D. or economist, but our conclusion is that the number will be very in line with expectations.

Crude fell below $90 after Russia said they are set to resume the oil flow in the pipeline through Ukraine. Inventory data out today is also, not expected to look great but it could change the direction of WTI. China said they are finished with military drills around Taiwan for now, but their war prep is not finished. Coinbase Sweetgreen and RBLX all fell significantly after earnings. SoftBank took a $34B gain in BABA reducing their stake significantly, bad time to do it since BABA is down over 50% in the past year. Biden signed the chips bill that will provide over $50B to US semi-companies, an attempt to make the US more competitive with China. India is swapping their USD for CNY to buy coal from Russia. Musk sold ~$7B of TSLA stock in case he must buy TWTR, smells like something else is going on here. Apparently, the FBI was looking for documents in Trump’s house and came out with several boxes of documents. DIS is set to report earnings tonight, investors have been punished with the stock so tonight will be big. Remember that river we keep bringing up, the Rhine, it is looking like part of it will be impassable by the 12th of August. Freight rates have increased more than 5x due to the difficulty of shipping and any lower levels will make passage impossible.

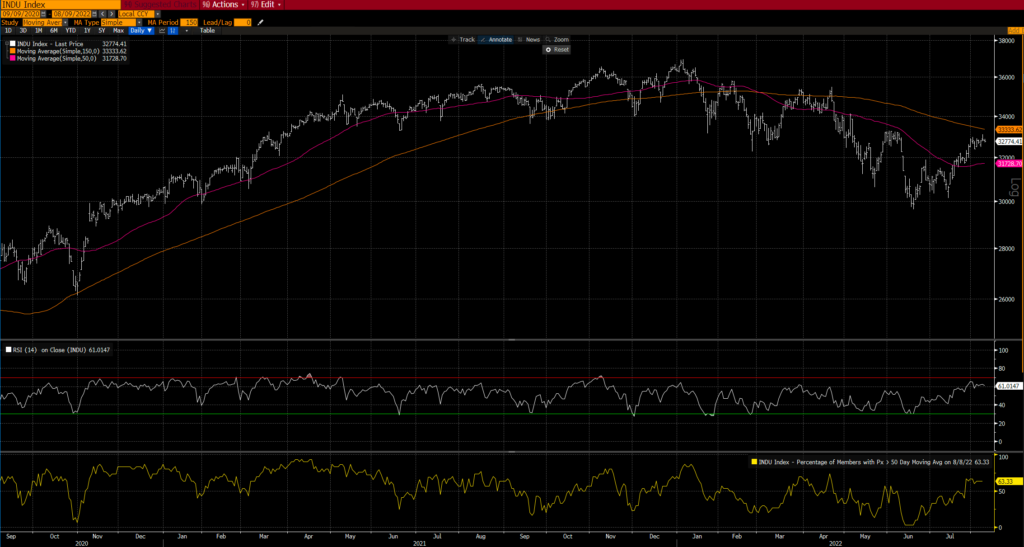

Looking at the indices we are at an absolutely critical moment. Evercore technical analyst called that it is time to buy, the bear market is over and the next Bull is here. He has been very right previously and is much smarter than I but I must disagree. It’s possible that a very mellow CPI print will send markets to the moon, but we doubt it. QQQ had a great rally, but it was rejected HARD at the downward sloping 200dma and bounced off from overbought territory.

The DOW wasn’t quite as overbought, but it is stalling just below the 200dma. The percent of DOW components above their 50dma peaked at around 70%, just the same as the last rally.

The SPX is in the same boat. The conditions look very similar to the last rally attempt, RSI peaking at 65, % above 50dma peaking @ 75%, and MACD looking strong but beginning to turn. You might say that a lot of this also happened when the market was ripping in 2021 but the market was in an uptrend not a downtrend.

CPI numbers today can change a lot and get us heading to new highs, but we still think this is a bear bounce. Working on a technical note right now, it will be out this morning or early afternoon. WHC TOP 5 PCTY, NET, ETSY, CROX, and EXTR