After the best month since 2020, DOW FUT down 0.03%, S&P FUT down 0.15%, NAS FUT down 0.09%, Oil pulling back 1.7% after weak China factory demand, US 10 yr up 1bps @ 2.656%. Asian markets closed in the green and Euro markets all sit comfortably in the green. 281 of S&P stocks have reported so far with a lot more earnings coming this week. On average earnings have been better than expected but guidance has all been pretty cautious.

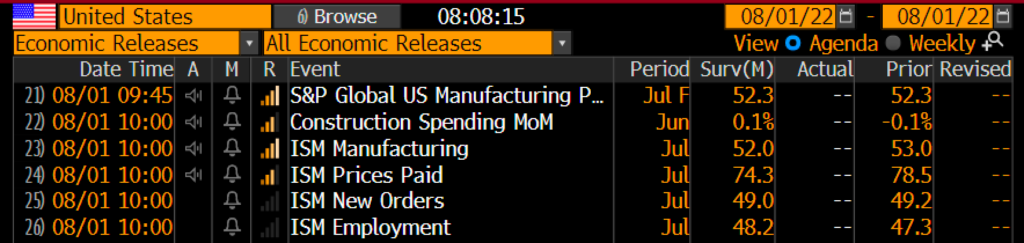

Upcoming economic news for today

The itinerary of US House Speaker Pelosi does not include a stop in Taiwan; however, reports say she will be there on the 2nd or 4th. Keep an eye out for another catalyst for China to get upset with the US. The first grain shipment since the invasion has just departed Ukraine.

Many are sighting this latest July rally as the end of the bear market and the bottom is already there. This may be right and we hope it is but we want to remind readers of the note from July 22nd. In longer bear markets, there are huge rallies. In the early 2000s bear market, we saw multiple rallies ~20%+, the same thing in 2008. We are currently about ~12% into this rally, when comparing to history, looks like a bear market rally.

WHC TOP 5

SEDG

CROX

ETSY

EQT

BAH

Trade idea

PINS straddle – 8/5 expiration, buy 20.50 call, buy 17.50 put, 1.78 total

Rember to check out on technical report from Friday. Reach out for access.