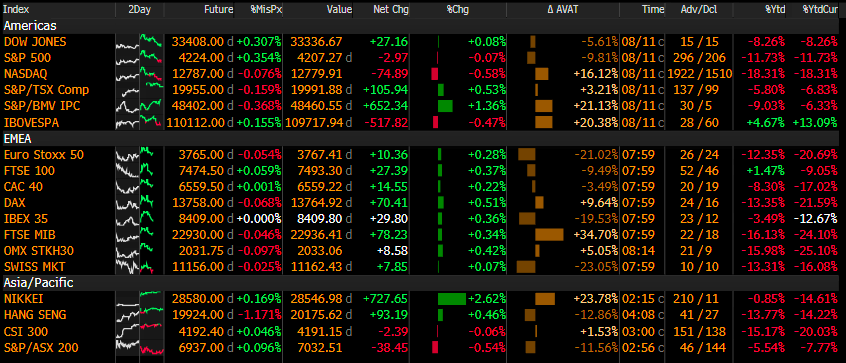

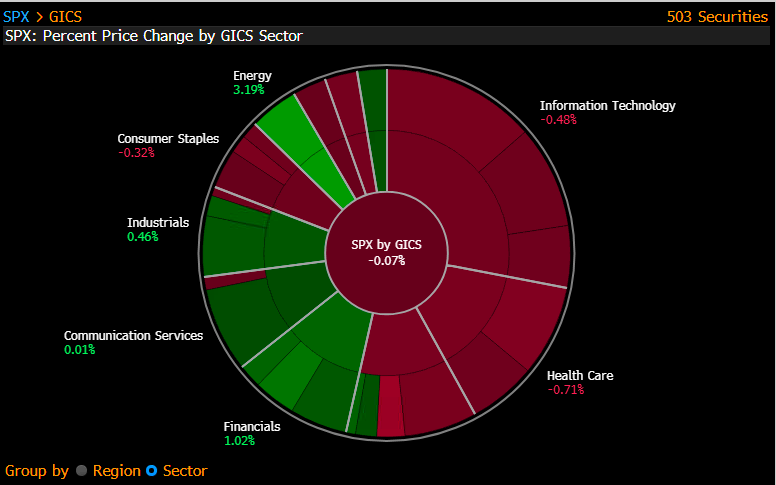

Its Friday and the market is heading for its 4th week of gains. DOW FUT up 0.32%, S&P up 0.39%, NAS up 0.44%, Oil pulling back 1.7% and the US 10yr is down just about 4bp @ 2.84%. Energy led the markets yesterday with infotech, healthcare, and con staples lagging.

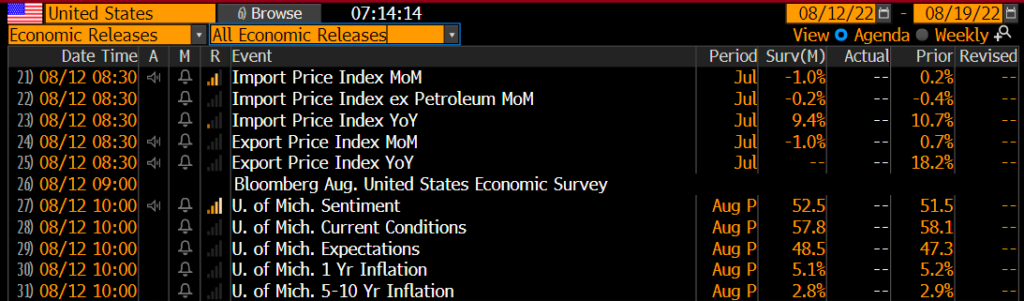

Yesterday’s action was not what we were expecting yesterday morning. The SPX and the NASDAQ ended the day in the red with the DOW just barely holding onto gains. The lower-than-expected PPI number that came out yesterday gave investors another piece of information that inflation was easing. Later in the day, a few fed officials came out saying that inflation was still too high for their comfort, and they will keep up with their fight until it gets to their target. It seems like some investors are fighting the Fed, they are telegraphing more hikes and the market doesn’t care. Some notable economic releases out today in the US, in the UK GDP QoQ contracted although less than expected.

A few things about yesterday We saw some subtle improvement in the % of stocks contributing to these gains, with almost 88% of stocks in the S&P above their 50dma. However, looking back in time, in the 2001 20%+ rally 89% of stocks were above their 50dma before crashing another 40%. It wasn’t until two years later when 90% of stocks were above their 50dma and the next bull market began. We are very close and could make it above 90% today, but in a bear market where things happen fast, be cautious until you get the facts. We think it was notable that the S&P and QQQs have been unable to close above their 150dma. The S&P failed yesterday to close above the 150dma and a level that would have been a 50% retracement.

Interestingly the equal weight S&P info tech index relative to the equal weight SPX, peaked on the 4th, at overbought conditions (The QQQ relative chart looks the same). The recent rally this week hasn’t retested those highs.

Similar thing for equal consumer discretion relative to the equal weight SPX, which actually saw its rally highs in late July.

The equal weight commutations services have done absolutely nothing and continue to test new lows. This sector includes GOOGL, META, NFLX, and many more who have historically led the market out of pullbacks. Not here.

CPI is coming down around the world potentially indicating that we have seen the worst. Drought across the world is adding to more environmental and economical fears. In Mexico, livestock are dying without enough drinking water. The French corn crop is at the lowest level in a decade as the drought and extreme heat makes it harder to keep the crop alive. Britain has officially entered a drought and the source of their famous Thames is the driest it has ever been. The Rhine River which connects much of inland Europe is likely to become impassable in Kaub, cutting off much of the southern river. This is likely to add stress to the region as the Rhine is usually an easy and cheap way to get coal to power plants, this could potentially trigger higher electricity prices.

All of this comes at the start of hurricane season which could trigger rigs to shut down operations in the Gulf. OPEC lowered its demand outlook for this year but energy markets didn’t care yesterday. Multiple Chinese stocks are set to delist from the NYSE, adding weakness to the Chinese listed names. The SEC is investigating Melvin Capital over practices and disclosures, likely liked to the GME mania.

A lot could happen today and we’d like to be wrong but we are still in the Bear Bounce camp. WHC TOP 5 PCTY, NET, ESTY, TTD, CROX