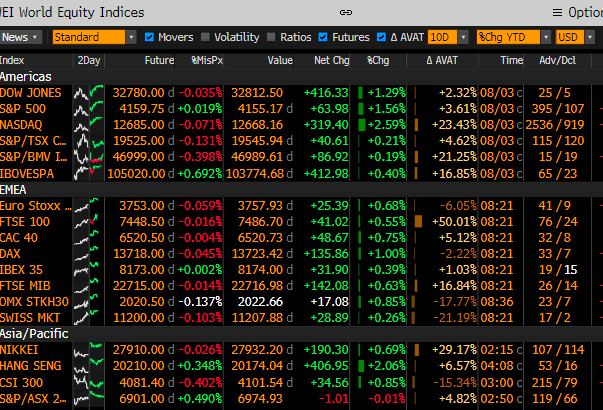

Futures are slightly in the green after a huge day yesterday, DOW FUT up 0.02%, S&P up 0.07%, NAS up 0.13%, Oil up 0.33% after another horrible day, gold up 1.3%, and the US 10yr pulled back 7bps @2.67%. All indices pared gains after job numbers came out.

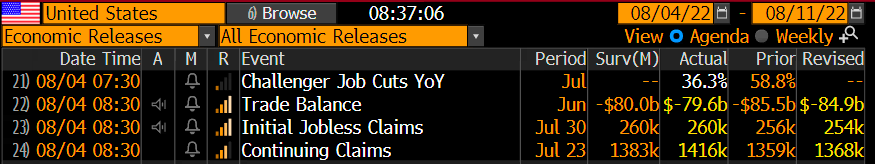

Initial Jobless claims came in just as expected and continuing claims were slightly higher, both are ticking up. Tons of companies are laying people off so we should start to see the number stack up soon enough.

The Bank of England increased rates 50bps, the largest hike in 27 years. In their statement, they said the UK will be in the longest recession since the financial crisis and expected to last all of next year. When you think the energy problem couldn’t get worse in Europe they get hit with a double whammy. Remember that river, the Rhine, we have been talking about recently? Due to the low levels and the inability to get coal to power plants, some of them might have to be shut off in Germany. Additionally, France may have to shut off some of its nuclear power plants because the heat is preventing them to cool the reactors. China is doing live drills around Taiwan and has stated that the median line no longer exists. The drills have gotten as close as 10 miles off Taiwan. Nancy really liked to stir the pot! She said that the real problem was that she was a woman and not that she was the speaker of the house. Maybe….? One of the largest cryptocurrencies/wallets, Solana, had a major breach of security and thousands of accounts were drained. Additionally, the SEC is expected to classify crypto as a digital commodity rather than a currency. More earnings continue rolling out. 409 S&P stocks have reported so far and beat earnings estimates by 5.12%. Better than we would have thought.

The market rallied yesterday, everything up more than 1% with the NAS up more than 2.5%. This is a significant change in leadership Tech & discretionary both making improvements relative to the SPX. Internally, yesterday’s winners and really the last month, are the losers YTD.

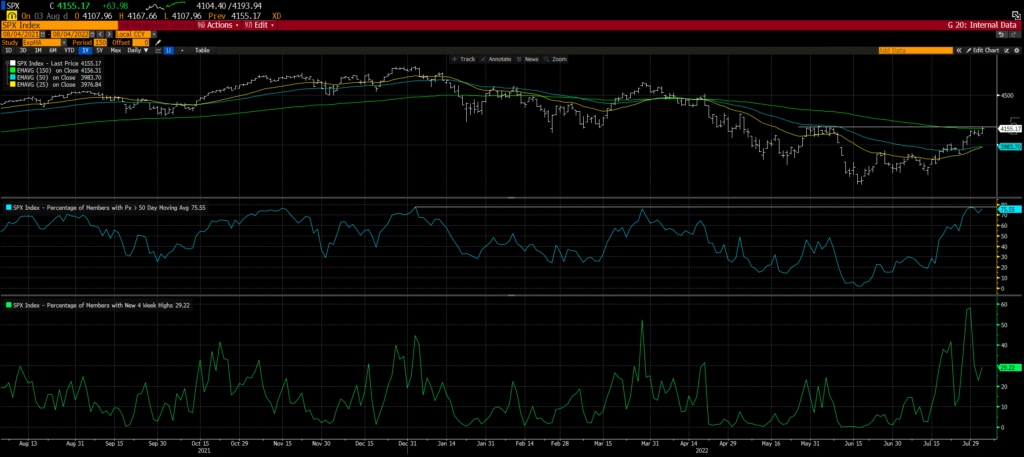

On the S&P It broke above a critical level, breaking through the 150dema. While it closed slightly below, it is sitting at a big resistance level and the next few days will be critical to see if it breaks above or if is restrained. Internally, the percentage of stocks that are above the 50dma needs to get higher to signal that we are past the ugly. While the SPX hit a new monthly high, the percentage of stocks at 20day highs is lower than it was last week. The internals needs to improve before we can say the mid-July bottom is actually the bottom.

Tech has been killing it recently, but the 2yr hasn’t budged during this rally. One would think if the fed is going to pivot in the near term the 2yr would have given up some ground. Still skeptical of this rally.

Bottom line, a recession seems likely, we don’t think the fed has reached “peak hawkishness” and we are still skeptical of the market rally. This is a stock pickers market and we are buyers of what’s working. WHC TOP 5: CROX (pullback in an uptrend), EXTR, ESTY, BAH, EQT. TAP has gotten slammed but we still like it. In an uptrend and breaking out of a huge base.