What a few days it has been while we have been on the road, SPX put in a new YTD low, the BOE gave into their tightening before it really even began and a Hurricane hit Florida. After yesterday’s huge day we are seeing another sell off. DOW -0.59%, S&P – 0.8%, NAS -1.09%, OIL +0.16%, Gold -0.69%, and the US 10yr is +12bps @3.83%. Asian markets closed mixed and European markets are in the red as the BOE hype has faded to the background. Some significant economic data out at 8:30 this morning.

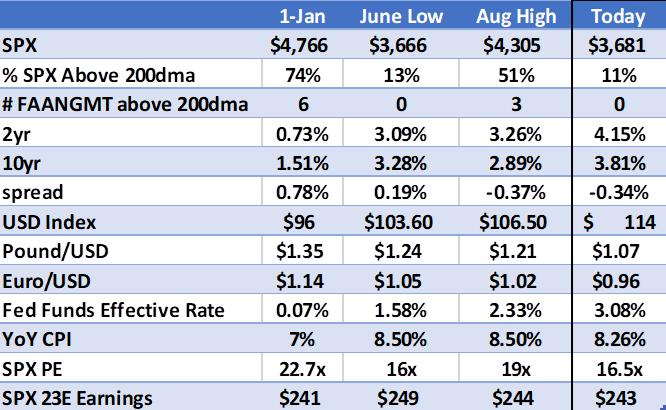

Earlier this week we saw broad and deep weakness within the markets. Market attempted to do some repairs yesterday which was a welcoming sign. We saw adv/dec of 11 to 1 with only 15% of SPX stocks making a new 4 weeks low. While a broad rally and pleasant up day, the market was rebounding from deep oversold conditions, the most oversold we have seen since early January. It is still our belief that when conditions are this oversold that it supports the greater trend rather than a buying opportunity. The market may have just put in a new low, but macro conditions are worse than they have been all year. Below is a chart made representing Sep 27th. When the internals are weak and the macro is getting weaker, it adds up to a grim outlook. We think that earnings est need to come down in order to see an accurate outlook.

The SPX has a new level of resistance (~3750) that it was rejected at yesterday, this is a minor level but should be seen as the first minor line it needs to break through. We are still amazed by the buy the dip mentality. Kathy Wood is launching a new product for investors to access the private markets and she continues to buy the beaten down stocks of the year (still seeing inflows into ARKK). Apple is a prime example of investors buying the dip yesterday. After being down over 4% at one point, the dip buyers bought into the weakness helping to have the stock end down just over 1.2%. We still believe that we need to see the giants like AAPL fall before a bottom can but put in. Watching closely but we still are cautious on believing that the bear market is over.

Market News:

The LME is considering a potential ban on Russian metals. SoftBank said it is planning on cutting 30% of vision fund staff. OPEC+ is meeting next week and there are discussions of cutting production, reports indicated that Russia suggested 1mmbpd cut. Russia is set to formally annex four regions today. Lithuania is urging Russian protesters to overthrow Putin. The Taliban have signed a deal for discounted Russian Oil, Gas and Wheat, a move that will potentially add stability to the region over the next six months as we ended a commodity shortage globally. The recent damage and leakage within the Nord pipelines appears to be the result of “deliberate, reckless and irresponsible acts of sabotage” said the Swedish Coast Guard. They also said that more leaks were detected than originally discovered. The German government has agreed on a relief package worth $145-194B to help with energy prices. Some fed presidents are debating over what the Fed can achieve. On one side Blanchard, Domash and summers say that it is impossible for the Fed to achieve a soft landing but on the other said Gov Waller and senior staffer Figura think that a soft landing is possible. Both sides agree that unemployment rate of 4.4% would be enough to return inflation to their target rate. The Fed reverse repo facility hit a new record on Sep 28th of $2.367T. Rumor has it that Biden is considering replacing Yellen at the midterm, likely an attempt to shift blame from the administration to Yellen. There is speculation that the Chinese’s central bank will begin to sell FX to support their local currency, the yuan is sitting around 7.1581. National rent has dropped for the first time in the last two years. Hurricane Tracker: Quite a time for us to have been on the road! Ian is all the talk, a cat 4 hurricane has ravaged Florida and Cuba. The storm has left most of Cuba and 2.5 million in Florida without power. Ian slowed intensity to a tropical storm early this morning as it heads north. Storm damages are estimated at $70B. The supply chain problems could be even worse, as million of people evacuated and damages hit the coast threatening to delay reopening of ports and trucking lanes. About 115mbpd of production were placed on hold heading into the storm which will likely come back on if the rigs were avoided.