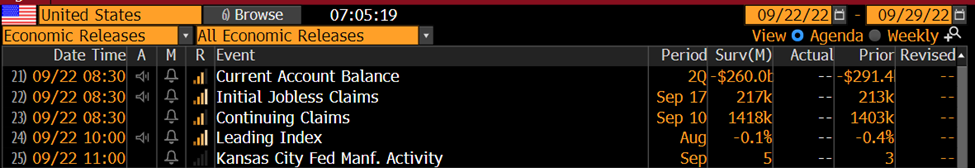

Holy indecision yesterday! Up into the rate news, down, up, down, up after Powell spoke, then absolute mayhem into the close. With the next low to test now the June lows the market is trying to comprehend what the next few months will look like. While the market is usually 6-12 months forward looking, things are much more short term today. The 2s/10s curve is nearing an inversion not seen since Volker days. Weak internals, slowing economy, hawkish Fed and geopolitical unrest the outlook is bleak to say the least. DOW FUT +0.16%, S&P +0.08%, NAS -0.02%, Gold +0.27%, Oil +1.15% and the US 10yr +3bps @3.54%. Asian markets closed in the red with the Yen popping after BOJ intervention. The Euro markets are all in the red after hawkish fed and BOE rate hikes. A few economic events out today.

Yesterday was quite the day to say the least. It was a very volatile day, we saw a 118pt and 839pt swing in the SPX & DOW. The S&P closed at a low last seen on June 30th, the NASDAQ closed at a low last seen in early July while the DOW closed at a low only to be rivaled by the June lows.

As we wrote yesterday, the market was very weak from within and that the market cannot turn without more support from within. While we saw a glimpse of hope right after Powell gave a few sprinkles of Dovishness, the deterioration continued into the close. With a Adv/Dec of -5 to 1 the breadth was not huge but still significant. Just 15% of stock in the SPX are above their 50dma, 24% are above their 200dma and 42% of stocks hit a new 4wk low, this is not strength. Oddly, Put/Call ratio is not doing much we would expect extreme levels of this to come while we get near a solid bottom. The lack of puts being bought means there is still too much bullish attitude in the market. The price action yesterday proves this, the buy the dip mentality is still there. With the Fed now expecting to hike another 125bps through year end, there is still a good way to go until this hiking cycle is finished. Something we have been saying and want to say again, a move form 75bps hike to 50bps is NOT a pivot. Powell was generally hawkish but with the little dovish tidbits got the market too excited to buy into the pivot narrative. We continue to believe that the fed funds rate needs to be higher than inflation in order to really squash demand and slow the economy. It is likely that inflation will come down more rapidly in the last few months of the year due to lag effect and lower commodity prices, however we still believe the June lows will be tested. Caution is your friend in this market.

Market News: The BOJ intervened with their FX markets and began buying Yen for the first time since 1998. The BOJ has kept rates extremely low which has depreciated the YEN ~20% this year. The BOE raised rates by another 50bps in its 7th consecutive hike and the longest cycle of hikes since the 1990s. Turkey cut their interest rates again as the country continues to see 80% inflation. Britain lifted their ban on gas fracking in hopes of getting more energy independence. Malaria and diseases are spreading fast in flood-hit Pakistan, the death toll has reached 324. Xi tells their arm forces that they should focus on preparing for war as the geopolitical tensions increase. Over 1000 people have been arrested in Russia at anti-war protests after the partial draft in the county. At the same time Ukraine threatens up to 5 years in prison if anyone votes in a referendum to join Russia. Hurricane tracker: Fiona heads to Bermuda and it left 8 people dead in Puerto Rico. Gaston still moving around in the middle of the Atlantic. One of those potential storms off Baja is now a tropical storm named Newton and it is heading out into the pacific. Three storms around the mid-Atlantic with varying degree of risk, one right off the north coast of Venezuela as a 70% chance of turning into a tropical storm.