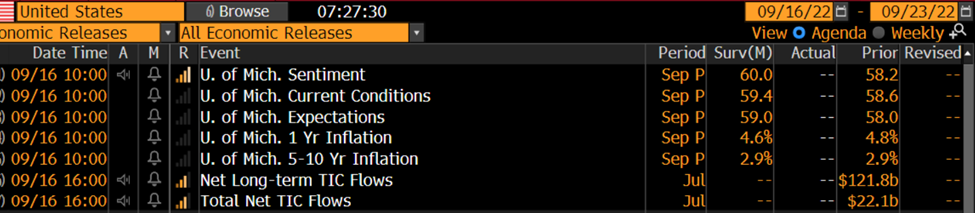

Markets got hit again yesterday after an attempt to close higher. The slide continues today with the DOW FUT -0.77%, S&P -0.85%, NAS -1.02%, Gold -0.21%, Oil holding in there +0.67%, and the US 10yr +1bps @3.469%. Asian markets closed in the red and European markets are in the down across the board. A few survey points out later today but all eyes are on the Fed meeting next week.

Yesterday the internals continued to weaken. Breadth was nothing special but adv/dec -2 to 1 with stocks above their 50dma continue to come down. Notably the support line we have been talking about for a few weeks was broken yesterday with the spx closing below it. With the internals weak and the support line broken, unless the Fed is oddly dovish, we suspect that we will test the lows.

Market news: The big news is FedEx this morning, pulling guidance for 2023 and reporting early and ugly quarter. The new CEO has said that the world is heading into a recession and that FedEx is at the middle of it all. This warning sent ripples across the sector and likely added to some of the negative sentiment this morning.